Lozenge plc has taken delivery of 50,000 electronic devices from a Malaysian company. The seller is in

Question:

Lozenge plc has taken delivery of 50,000 electronic devices from a Malaysian company. The seller is in a strong bargaining position and has priced the devices in Malaysian dollars at M$12 each. It has granted Lozenge three months’ credit.

The Malaysian interest rate is 3 per cent per quarter.

Lozenge has all its money tied up in its operations but could borrow in sterling at 3 per cent per quarter (three months) if necessary.

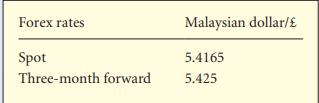

ter (three months) if necessary. Forex rates Malaysian dollar/£ Spot 5.4165 Three-month forward 5 .425 A three-month sterling put, Malaysian dollar call currency option with a strike price of M$5.425/£ for M$600,000 is available for a premium of M$15,000.

Required

Discuss and illustrate three hedging strategies available to Lozenge. Weigh up the advantages and disadvantages of each strategy. Show all calculations.

Step by Step Answer: