To see how, in principle, an investor can lock an interest rate for a future time interval

Question:

To see how, in principle, an investor can lock an interest rate for a future time interval [ \(T T+025]\), imagine that she takes a long position in one contract when the quote is 97.22 (futures rate is \(2.78 \%\) ). If the spot rate at maturity is \(2.5 \%\), the final settlement futures price will be 97.50, and if we disregard the time value of the daily cash flows, the net gain will be

\[\$ 25 \quad(97.50 \quad 97.22)=\$ 700\]

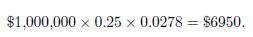

She will invest \(\$ 1,000,000\) at the spot rate \(2.5 \%\) for three months, earning

![]()

Adding the \(\$ 700\) profit from the futures position, she earns a total of \(\$ 6950\) and, apparently, she has the same gain as with a locked rate of \(2.78 \%\),

However, we have disregarded the possibility of investing daily profits (and the need of financing daily losses) due to marking-to-market of futures contracts. In other words, we are considering the futures contract as a forward.

Step by Step Answer:

An Introduction To Financial Markets A Quantitative Approach

ISBN: 9781118014776

1st Edition

Authors: Paolo Brandimarte