A sufficient condition to produce positively weighted efficient portfolios is that the variance- covariance matrix be diagonal:

Question:

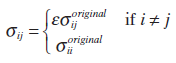

A sufficient condition to produce positively weighted efficient portfolios is that the variance- covariance matrix be diagonal: That is, that ?ij = 0, for i ? j. By continuity, positively weighted portfolios will result if the off-diagonal elements of the variance covariance matrix are suffi ciently small compared to the diagonal. Consider a transformation of the above matrix in which:

When ? = 1, this transformation will give the original variance-covariance matrix and when ? = 0, the transformation will give a fully diagonal matrix. For r = 10% find the maximum ? for which all portfolio weights are positive.

PortfolioA portfolio is a grouping of financial assets such as stocks, bonds, commodities, currencies and cash equivalents, as well as their fund counterparts, including mutual, exchange-traded and closed funds. A portfolio can also consist of non-publicly...

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Question Posted: