As shown in this chapter, Merton (1973) shows that for the case of an asset with price

Question:

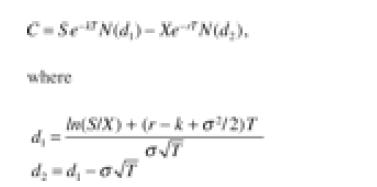

As shown in this chapter, Merton (1973) shows that for the case of an asset with price S paying a continuously compounded dividend yield k, this leads to the following call option pricing formula:

a. Modify the BSCall and BSPut functions defined in this chapter to fit the Merton model.

b. Use the function to price an at-the-money option on an index whose current price is S = 1500, when the option’s maturity T = 1, the dividend yield is k = 2.2%, its standard deviation σ = 20%, and the interest rate r = 1%.

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Question Posted: