Fromms sensitivity analysis will result in a decrease in the 2020 base case gross profit margin closest

Question:

Fromm’s sensitivity analysis will result in a decrease in the 2020 base case gross profit margin closest to:

A. 0.55 percentage points.

B. 0.80 percentage points.

C. 3.32 percentage points.

Gertrude Fromm is a transportation sector analyst at Tucana Investments. She is conducting an analysis of Omikroon, N.V., a (hypothetical) European engineering company that manufactures and sells scooters and commercial trucks.

Omikroon’s petrol scooter division is the market leader in its sector and has two competitors. Omikroon’s petrol scooters have a strong brand name and a well-established distribution network. Given the strong branding established by the market leaders, the cost of entering the industry is high. But Fromm anticipates that small, inexpensive, imported petrolfueled motorcycles could become substitutes for Omikroon’s petrol scooters.

Fromm uses ROIC as the metric to assess Omikroon’s performance.

Omikroon has just introduced the first electric scooter to the market at year-end 2019.

The company’s expectations are as follows:

• Competing electric scooters will reach the market in 2021.

• Electric scooters will not be a substitute for petrol scooters.

• The important research costs in 2020 and 2021 will lead to more efficient electric scooters.

Fromm decides to use a five-year forecast horizon for Omikroon after considering the following factors:

Factor 1 The annual portfolio turnover at Tucana Investments is 30%.

Factor 2 The electronic scooter industry is expected to grow rapidly over the next 10 years.

Factor 3 Omikroon has announced it would acquire a light truck manufacturer that will be fully integrated into its truck division by 2021 and will add 2% to the company’s total revenues.

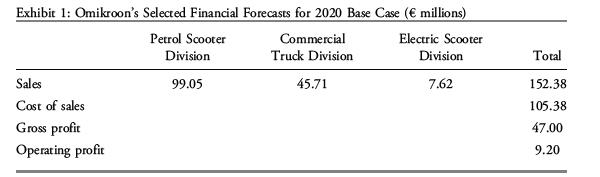

Fromm uses the base case forecast for 2020 shown in Exhibit 1 to perform the following sensitivity analysis:

• The price of an imported specialty metal used for engine parts increases by 20%.

• This metal constitutes 4% of Omikroon’s cost of sales.

• Omikroon will not be able to pass on the higher metal expense to its customers.

Omikroon will initially outsource its electric scooter parts. But manufacturing these parts in-house beginning in 2021 will imply changes to an existing factory. This factory cost EUR7 million three years ago and had an estimated useful life of 10 years. Fromm is evaluating two scenarios:

• Sell the existing factory for EUR5 million. Build a new factory costing EUR30 million with a useful life of 10 years.

• Refit the existing factory for EUR27 million.

Step by Step Answer:

Corporate Finance Workbook Economic Foundations And Financial Modeling

ISBN: 9781119743811

3rd Edition

Authors: CFA Institute, Michelle R. Clayman, Martin S. Fridson, George H. Troughton