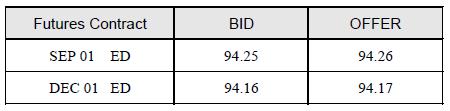

Suppose that the table below lists prices of two Eurodollar time deposit contracts quoted on the Chicago

Question:

Suppose that the table below lists prices of two Eurodollar time deposit contracts quoted on the Chicago Mercantile Exchange on June 12, 2001.

The date is June 12, 2001. A corporate treasurer wishes to increase working capital $40 million by drawing down a bank loan based on six-month LIBOR on September 14, 2001. What financial risk does the corporate treasury face now, and how can this risk be hedged using Eurodollar futures? Describe the hedge stating how many of which contract(s), the transaction involved (buy or sell) and the likely dealing price.

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Financial Modeling For Managers With Excel Applications

ISBN: 9780970333315

2nd Edition

Authors: Dawn E. Lorimer, Charles R. Rayhorn

Question Posted: