The weight of equity in Strattons capital structure as a result of the acquisition of Midwest assuming

Question:

The weight of equity in Stratton’s capital structure as a result of the acquisition of Midwest assuming Lee’s two assumptions is closest to:

A. 29%.

B. 71%.

C. 81%.

Elaine Lee is an analyst at an investment bank covering the energy sector. She and her junior analyst are analyzing Stratton Oil Corporation.

Stratton Oil Corporation is a publicly traded, US-based energy company that just announced its acquisition of Midwest Oil Corporation, a smaller US-based energy company.

Stratton will pay USD55 in cash and 2.25 Stratton shares for each Midwest share, for a total consideration of USD40 billion based on share prices just prior to the announcement.

Stratton’s current trading enterprise value just prior to the announcement was USD170 billion. Lee concludes that the acquisition does not signal a change in strategy or focus for Stratton.

Stratton expects to realize annual recurring cost synergies of USD350 million (pre-tax), primarily from efficiencies in oil exploration and production activities and savings in corporate costs. The achievement of the full USD350 million in synergies is expected by the end of the third year after the acquisition closes. Synergies are realized in the amounts of USD117 million, USD233 million, and USD350 million in Years 1–3, respectively, and cash costs of USD175 million, USD280 million, and USD395 million are incurred in Years 1–3, respectively.

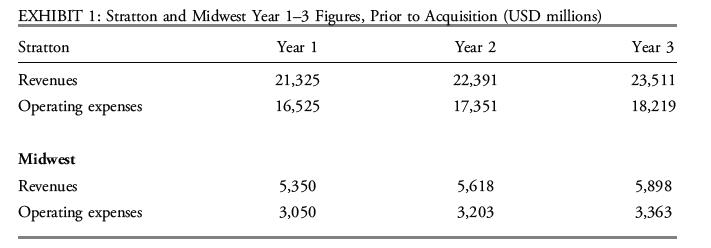

Expectations for revenues and total operating expenses for Stratton and Midwest for the next three years prior to the acquisition announcement are shown in Exhibit 1.

Lee’s junior analyst makes the following comment during a conversation with Lee:

The acquisition is considered immaterial in the initial evaluation step for Stratton because it does not signal a change in strategy or focus.

Stratton’s offer valued Midwest at an enterprise value of USD40.6 billion, including USD4.3 billion of existing Midwest debt. To finance the consideration of USD55 in cash and 2.25 Stratton shares for each Midwest share, Stratton will issue 104 million new shares and raise approximately USD26 billion in new debt and fund the remainder with cash on hand.

Following the close, Stratton expects its outstanding debt will be approximately USD62 billion. Prior to the acquisition, Stratton has 1.096 billion shares outstanding trading at USD125 per share. Lee wants to determine how much the weights of debt and equity in Stratton’s capital structure will change assuming a constant share price and that the book value of debt equals its market value.

During an internal meeting, Lee asks if Stratton could have achieved its same goals by undertaking an equity investment or joint venture. In response, Lee’s junior analyst makes the following three statements.

Statement 1: Acquisitions require substantially greater capital investments than equity investments.

Statement 2: Acquisitions and equity investments are similar in that they both allow the acquirer to gain control of the target.

Statement 3: Relative to joint ventures, equity investments provide more equal governance representation and require larger investments.

Lee conducted a sum-of-the-parts valuation of Stratton’s three segments and calculated an estimated enterprise value of USD187 billion just prior to the announcement.

Step by Step Answer:

Corporate Finance Workbook Economic Foundations And Financial Modeling

ISBN: 9781119743811

3rd Edition

Authors: CFA Institute, Michelle R. Clayman, Martin S. Fridson, George H. Troughton