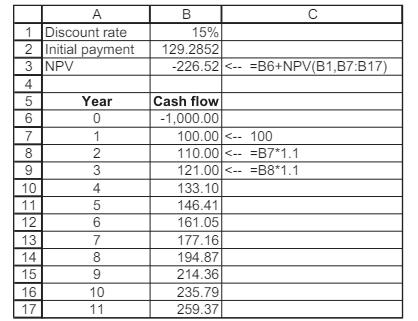

You are offered an investment with the following conditions: The cost of the investment is $1,000.

Question:

You are offered an investment with the following conditions:

• The cost of the investment is $1,000.

• The investment pays out a sum X at the end of the fi rst year; this payout grows at the rate of 10 percent per year for 11 years.

If your discount rate is 15 percent, calculate the smallest X that would entice you to purchase the asset. For example, as you can see in the following display, X = $100 is too small—the NPV is negative.

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Question Posted: