Question:

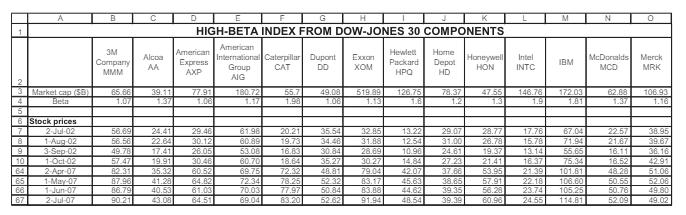

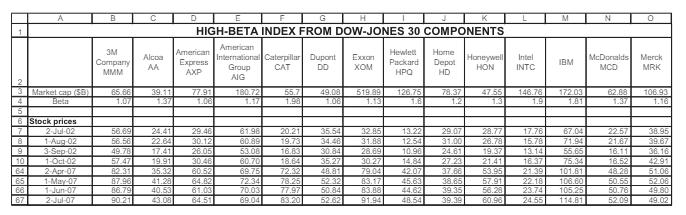

You have decided to create your own index of high-beta components of the DowJones 30 Industrials. Using Yahoo’s stock screener, you come up with the following data.

a. Compute the variance-covariance matrix of returns.

b. Assuming that the risk-free rate is 5.25% annually (=5.25%/12=0.44% monthly). and that the expected high-beta index annual return is 12% (= 1% monthly), compute the Black-Litterman monthly expected returns for each stock.

Transcribed Image Text:

C D HIGH-BETA INDEX FROM DOW-JONES 30 COMPONENTS M N Company Alcoa AA MMM American Express AXP American International Caterpillar Dupont Exxan Group CAT AIG Hewlett Home 00 Packard Depot HPQ Honeywell Intel HON INTC McDonalds Merck IBM MCD MRK HD 3 Market cap (SD) 65.66 39.11 180.72 55.7 49.08 519.89 126.75 78.37 4 Beta 1.07 1.90 1.06 1.13 1.8 1.2 47.55 1.3 146.78 1.9 172.03 62.88 106.93 1.81 1.16 5 6 Stock prices 7 2-Jul-02 56.69 24.41 29.46 61.98 20.21 35.54 32.85 13.22 29.07 28.77 17.76 67.04 22.57 38.95 8 1-Aug-02 56.56 22.64 30.12 60.89 19.73 34.48 31.88 12.54 31.00 26.78 15.78 71.94 21.67 39.67 9 3-Sep-02 49.78 17.41 26.05 53.08 16.83 30.84 28.69 10.96 24.61 19.37 13.14 55.65 16.11 36.16 10 1-Oct-02 57.47 19.91 30.46 60.70 18.64 35.27 30.27 14.84 27.23 21.41 16.37 75.34 16.52 42.91 64 2-Apr-07 82.31 35.32 60.52 69.75 72.32 48.81 79.04 42.07 37.66 53.95 21.39 101.81 48.28 51.08 85 1-May-07 87.96 41.28 64.82 72.34 78.25 52.32 83.17 45.63 38.85 57.91 22.18 106.60 50.55 52.06 66 1-Jun-07 86.79 40.53 61.03 70.03 77.97 50.84 83.88 44.62 39.35 56.28 23.74 105.25 50.76 49.80 67 2-Jul-07 90.21 43.08 64.51 69.04 83.20 52.62 91.94 48.54 39.39 60.96 24.55 114.81 52.09 49.02