Question:

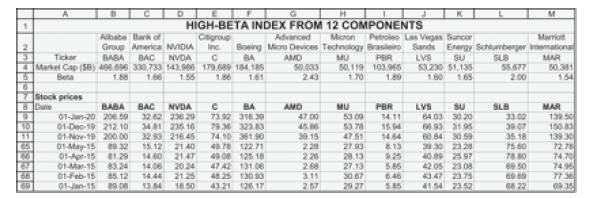

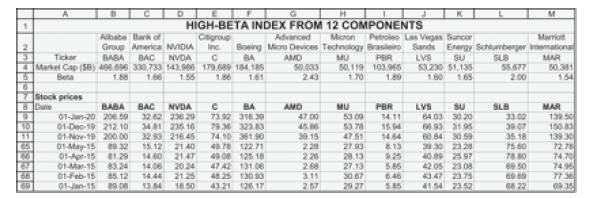

You have decided to create your own index of higher-beta components of the Dow-Jones 30 Industrials. Using Yahoo’s stock screener, you come up with the following data:

a. Compute the variance-covariance matrix of returns.

b. Assuming that the risk-free rate is 1.2% annually (=1.2%/12 = 0.1% monthly), and that the expected high-beta index annual return is 12% (= 1% monthly), compute the BL monthly expected returns for each stock.

Transcribed Image Text:

1 2 3 6 Beta CO H M Marriot HIGH-BETA INDEX FROM 12 COMPONENTS Cigroup Advanced Micron Petroleo Las Vegas Suncor Inc Boeing Micro Devices Technology Brasileiro Sands Energy Schlumberger International C BA SU 53.230 51.135 1.60 Albabe Bark of Group America NVIDIA BAC NVDA Market Cap (58) 406,596 300.733 143.986 179.689 184,185 Ticker 1.88 1.66 1.56 1.86 161 AMD 50.000 MU PBR 50.119 103.965 LVS 2.43 1.70 1.80 SUB MAR 55.677 50.381 1.65 2.00 154 6 Stock prices Date 10 11 BABA 01-Jan-20 20650 01-Dec-19 212.10 01-Nov-19 200.00 BAC NVDA 32.62 236.29 34.81 235 16 32.90 216.45 C 73.92 316.30 79.36 323.83 BA AMD MU PBR LVS SU SLB MAR 47.00 53.09 14.11 64.03 30.20 33.00 139.50 45.86 53.78 15.04 6693 31.95 39.07 15083 74.90 361.90 30.15 47.51 14.64 60.84 30.59 35.18 139.30 65 01-May-15 0.32 15.12 21.40 49.78 122.71 2.20 27.03 8.13 39.30 23.28 75.60 72.78 66 01-Apr-15 81.29 14.60 21.47 49 08 125 18 2.20 20.13 9.25 40.09 25.97 78.80 74.70 67 01-Mar-15 83.24 14.06 20.24 47.42 131.06 268 27.13 5.85 42.05 23.08 69.50 74.95 68 01-Feb-15 85.12 14.44 2125 48.25 130.00 3.11 30.67 6.46 43.47 23.75 69.60 7736 60 01-Jan-15 89.ce 13.84 16.50 43.21 126 17 257 29 27 5.85 41.54 23.52 68.22 0935