Allison Manufacturing and BS} Manufacturing both produce after-market accessories for sports utility vehicles. Both companies are about

Question:

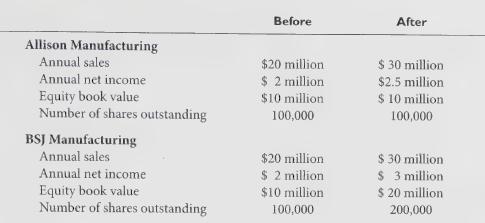

Allison Manufacturing and BS} Manufacturing both produce after-market accessories for sports utility vehicles. Both companies are about to launch strategic initiatives that will increase sales and net income for the foreseeable future. Allison has decided to launch an expensive advertising campaign that will increase sales from $20 million to $30 million a year and net income from $2 million to $2.5 million a year. BSJ has decided to issue an additional $10 million of common stock and then use the proceeds to buy a smaller accessories manufacturer. The acquisition is expected to increase BSJ’s sales by $10 million a year and net income by $1 million. Key financial statement figures for both companies follow. The “before” amounts describe each company’s current operations, and the “after” amounts incorporate the expected results from the strategic initiatives.

Both companies pay all net income out as dividends each year and have a 10% cost of equity capital. Use the abnormal earnings valuation model from equation (6.11) to answer the required questions.

Required:

1. Calculate the per share value of each company before it undertakes its strategic initiatives assuming that its current levels of annual net income can be sustained forever.

2. Calculate the percentage growth rate in sales and net income that each company will experience as a result of its strategic initiatives. What is the ROCE for each company before and after its strategic initiative?

3. Calculate the per share value of each company after it implements its strategic initiative assuming that the new expected level of annual net income can be sustained forever.

4. Explain why the per share value of one company increases while the per share value of the other company declines.

Step by Step Answer: