As described in the chapter, the abnormal earnings approach for estimating common share value is where P

Question:

As described in the chapter, the abnormal earnings approach for estimating common share value is

where P is the total value of all outstanding shares, BV is the (beginning) book value of stockholders’ equity, r is the cost of equity capital, E is the expectations operator, and X is net income. In words, the model says that share value equals the book value of stockholders’

equity plus the present value of future expected abnormal earnings (where abnormal earnings is net income minus the cost of equity capital multiplied by the beginning-of-period book value of stockholders’ equity).

The approach is amazingly simple. Two “rubs” are that the model is silent on just how one comes up with expected net income for future years (and therefore future expected abnormal earnings) and just how many future years should be used. Because of the way present value is calculated, abnormal earnings amounts expected for years in the distant future have a small present value and are essentially irrelevant to valuation. In addition, competitive market forces tend eventually to drive abnormal earnings to zero. Thus, it ism’t important to make the forecasting horizon terribly long. Professional analysts rarely use more than 15 years, often fewer than 10.

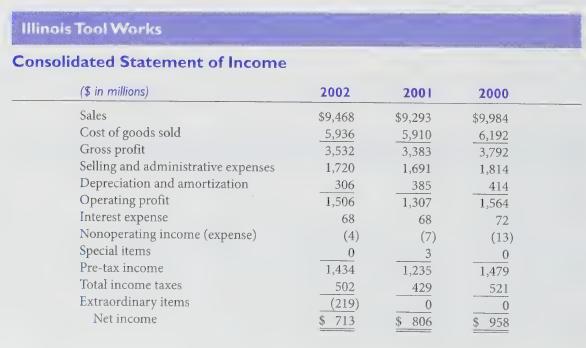

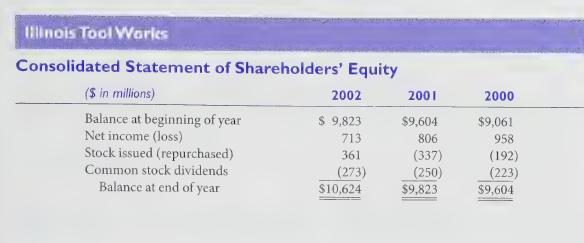

Comparative income statements and retained earnings statements for Illinois Tool Works (ITW) for 2000-2002 follow.

Required:

1. Assume a 10-year forecasting horizon. Also assume that ITW’s 2002 return on beginning stockholders’ equity (net income without extraordinary items divided by beginning 2002 stockholders’ equity) of 9.5% is expected to persist throughout the forecasting horizon (that is, that expected net income is always equal to 0.095 multiplied by beginning-of-the year stockholders’ equity). Also assume that no additional stock issuances or repurchases are made and that dividends equal 25% of net income in each year. (This is IT W’s approximate historical dividend payout ratio.) Given these assumptions, the book value of stockholders’

equity at the end of 2003 equals book value at the beginning of 2003 plus (1 — 0.25)

times 2003 net income. Finally assume that the cost of equity capital is 9%. (This is IT W’s approximate cost of equity capital.) With these relatively simple assumptions, use the abnormal earnings model to estimate the total value of Illinois Tool Works’ common shares as of the end of 2002. Ignore terminal values at the end of the 10-year forecast horizon in your calculations.

2. As of the end of 2002, 307 million common shares were outstanding. Convert your estimate in requirement | to a per share estimate. For purposes of comparison, the actual market value of ITW’s common shares ranged from $56 to $64 during the first quarter of 2003.

3. Now assume that ITW will maintain a 20% return on beginning stockholders’ equity over the 10-year forecast horizon. What would the company’s shares then be worth?

Step by Step Answer: