As discussed in the chapter, abnormal earnings (AE) are AE t = X t (r e

Question:

As discussed in the chapter, abnormal earnings (AE) are

AEt = Xt − (re × BVt−1)

where Xt is the firm’s net income, re is the cost of equity capital, and BVt–1 is the book value of equity at t − 1.

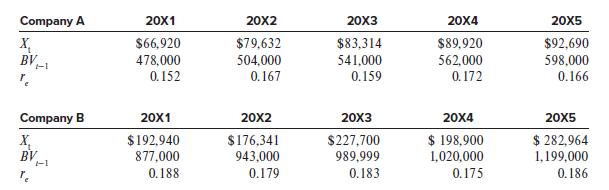

Following are Xt, BVt–1, and re for two firms.

Required:

1. Calculate each firm’s AEt each year from 20X1 to 20X5.

2. Which firm was better managed over the 20X1–20X5 period? Why?

3. Which firm is likely to be the better stock investment in 20X6 and beyond? Why?

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Financial Reporting And Analysis

ISBN: 9781260247848

8th Edition

Authors: Lawrence Revsine, Daniel Collins, Bruce Johnson, Fred Mittelstaedt, Leonard Soffer

Question Posted: