Barbara Trading Company has used the LIFO method of inventory accounting since its inception in 1990. At

Question:

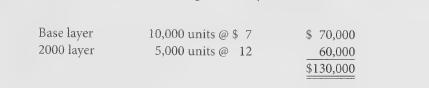

Barbara Trading Company has used the LIFO method of inventory accounting since its inception in 1990. At December 31, 2006, the ending inventory was:

The company uses the periodic inventory method that assumes sales were made from the last inventory units acquired Guring the year (periodic LIFO). The purchase and sales prices change only once a year on January 1. Operating expenses are $600,000 per year, and the income tax rate is 40%.

During 2008, the company implemented a new inventory management program to reduce the level of inventory carried.

Required:

1. Prepare Barbara's income statements for the years 2007 and 2008.

2. Barbara’s CEO, I. M. Greedy, examined the effect of the new inventory management program on the company’s inventory turnover. After doing some quick calculations, she was overjoyed. “When our competitors are turning their inventory over 12 to 15 times a year, our inventory turnover for 2008 has exceeded 30!” How did the CEO estimate the inventory turnover ratio for 2008? Based on all available information, provide an estimate of Barbara’ true inventory turnover during 2008. Assume that the competitors’ turnovers were based on data from their financial statements. What might be the potential limitations of comparing Barbara's inventory turnover with its competitors’? Show supporting figures where necessary. /

3. Greedy was also quite ecstatic about the company’s overall performance during 2008.

“I am extremely pleased with the growth in our bottom line. Although some of the growth is probably due to the increase in selling price, most of it appears to be the result of our new inventory management program.” Prepare a memo to her explaining the true reasons behind the change in net income from 2007 to 2008. Show supporting figures when necessary. Also critically evaluate the CEO’s rationale for the growth in earnings.

4. Barbara Trading Company's CFO, I. M. Taxed, was rather concerned about the tax implications of reducing inventory levels. He was lamenting, “I told you all about the LIFO boomerang. We could have avoided paying a lot of taxes that resulted from our inventory liquidations had we adopted FIFO in the first place.’ Evaluate the CFO's analysis of the LIFO tax effects.

Step by Step Answer: