The following inventory footnote is taken from Gardner Denvers Year 3 annual report. You are to use

Question:

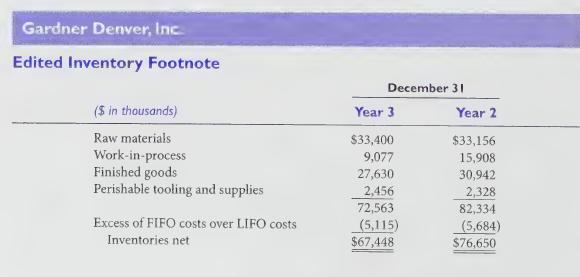

The following inventory footnote is taken from Gardner Denver’s Year 3 annual report. You are to use this information in answering the questions that follow.

During Year 3, Year 2 and Year 1, reductions in inventory quantities (net of acquisitions) resulted in liquidations of LIFO inventory layers carried at lower costs prevailing in prior years. The effect was to increase net income in Year 3, Year 2 and Year 1 by \($268\), \($319\) and \($427\), respectively.

Required:

1. By how much would net income for Year 3 have differed had Gardner Denver used FIFO to value those inventory items valued under LIFO? Assume a 35% marginal tax rate. Be sure to indicate whether FIFO income would be higher or lower than LIFO income.

2. What would the LIFO reserve have been on December 31, Year 3 if no LIFO liquidation had occurred in Year 3?

3. What was the net difference in Year 3 income taxes that Gardner Denver experienced as a result of using LIFO rather than FIFO? Assume a 35% tax rate and indicate whether FIFO or LIFO would yield the higher tax and by how much.

4. What was the approximate rate of change in input costs in Year 3 for Gardner Denver's inventory?

Step by Step Answer: