Cemex is one of the worlds largest cement companies. Based in Monterrey, Mexico, the company has significant

Question:

Cemex is one of the world’s largest cement companies. Based in Monterrey, Mexico, the company has significant operations in such diverse economies as those of the United States, Spain, Venezuela, Colombia, Thailand, and Egypt. Some of these countries have recently experienced substantial inflation.

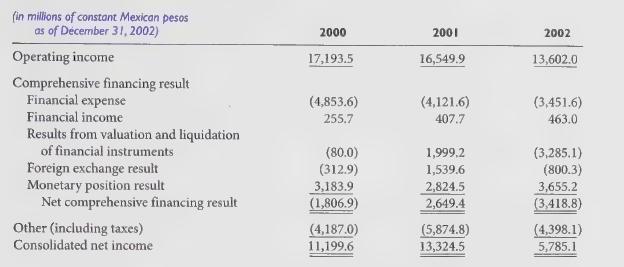

The following table summarizes the consolidated income statements presented in Cemex’s 2002 annual report. As the chapter discussed, Mexican FRS requires companies to make various adjustments for the effects of inflation. One adjustment is to present comparative income statements and balance sheets in units of constant purchasing power. Another is to recognize a gain or loss from holding monetary items. Cemex refers to its net gain from holding monetary items as its “monetary position result.”

In its 2002 report, Cemex disclosed that domestic Mexican inflation rates were 9.03%, 4.56%, and 5.53% in 2000, 2001, and 2002, respectively. These rates were substantially below those that generally prevailed in the 1990s. Cemex also provided a weighted average inflation rate computed across all the economies in which the company operates. In 2002, this multicountry rate grew from comparatively low levels to 9.16%, substantially above the domestic Mexican rate of inflation. Cemex specifically cited hyperinflation in Venezuela of 31.2% as having affected its performance in 2002.

Required:

1. Does holding a monetary asset exposed to the effects of inflation result in a monetary gain or monetary loss? What about a monetary liability? Explain.

2. Cemex consistently reports gains classified as “monetary position results.” Is the company in a net monetary asset or liability position; that is, does the company have a higher amount of monetary assets or liabilities? Explain.

3. Why might the monetary position result for 2002 be higher than for 2000 despite the fact that Mexican inflation was substantially lower?

4. Cemex’s 2001 annual report calculates consolidated net income for 2000 and 2001 as 10,259.8 and 12,206.4 million pesos, respectively. These figures differ from the numbers for 2000 and 2001 consolidated net income as presented. Can you explain the discrepancy?

Step by Step Answer: