Current tax law limits the amount of interest expense that corporations may deduct to the sum of

Question:

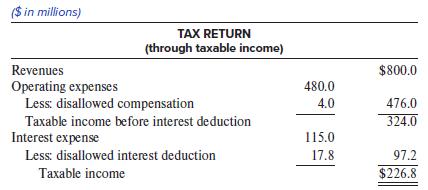

Current tax law limits the amount of interest expense that corporations may deduct to the sum of (a) taxable interest income and (b) 30% of taxable income (excluding taxable interest income) before any deductions for interest, depreciation, amortization, or depletion. However, the law permits any disallowed interest expense to be carried forward indefinitely. So, for example, if a firm had $10 million of interest deduction disallowed because of the limitation in one year, it could add $10 million to the interest expense it actually incurred the following year and deduct that entire amount, although again subject to the 30% limitation. Presented below are Zagunis Corporation’s 20X1 U.S. GAAP income statement (through pre-tax income) and its tax return (through taxable income).

($ in millions) | |

U.S. GAAP INCOME STATEMENT (through pre-tax income) | |

Revenues | $ 800 |

Operating expenses | 480 |

Operating income | 320 |

Interest expense | 115 |

Pretax income | $ 205 |

Included in Zagunis’s operating expenses is $4 million of compensation expense that is not deductible because it exceeds the maximum amount of executive compensation that is permitted to be deducted under tax law. Unlike the interest expense, the excess compensation may not be carried forward.

Zagunis has no book-tax differences other than the compensation and interest expenses. It had no deferred tax asset or liability at December 31, 20X0. It had no interest income, or deductions for depreciation, amortization, or depletion. Assume a 21% corporate tax rate for 20X1.

Required:

1. What amount of deferred tax asset or deferred tax liability, if any, does Zagunis report at December 31, 20X1?

2. What amount of income tax expense does Zagunis report in 20X1?

Step by Step Answer:

Financial Reporting And Analysis

ISBN: 9781260247848

8th Edition

Authors: Lawrence Revsine, Daniel Collins, Bruce Johnson, Fred Mittelstaedt, Leonard Soffer