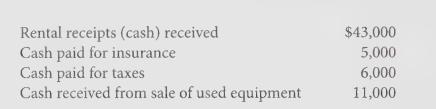

During the month of October 2008, HAWK-I Rentals had the following cash receipts and payments: Of the

Question:

During the month of October 2008, HAWK-I Rentals had the following cash receipts and payments:

Of the rental receipts collected, \($2,000\) was reported as Rent receivable at September 30, and \($3,500\) was a prepayment of November’s rent. An insurance premium of \($1,000\) was owed at the end of October. Taxes of \($1,000\) and \($700\) were owed at October 1 and October 31, respectively. Equipment sold in October had a book value (cost — accumulated depreciation) of \($12,200\) at the time of sale.

Required:

1. Determine rental income for October 2008.

2. Determine insurance expense for October 2008.

3. Determine tax expense for October 2008.

4. Assuming that the accumulated depreciation on the equipment sold was \($1,300\), what is the appropriate journal entry to record the sale of the used equipment?

Step by Step Answer: