Question:

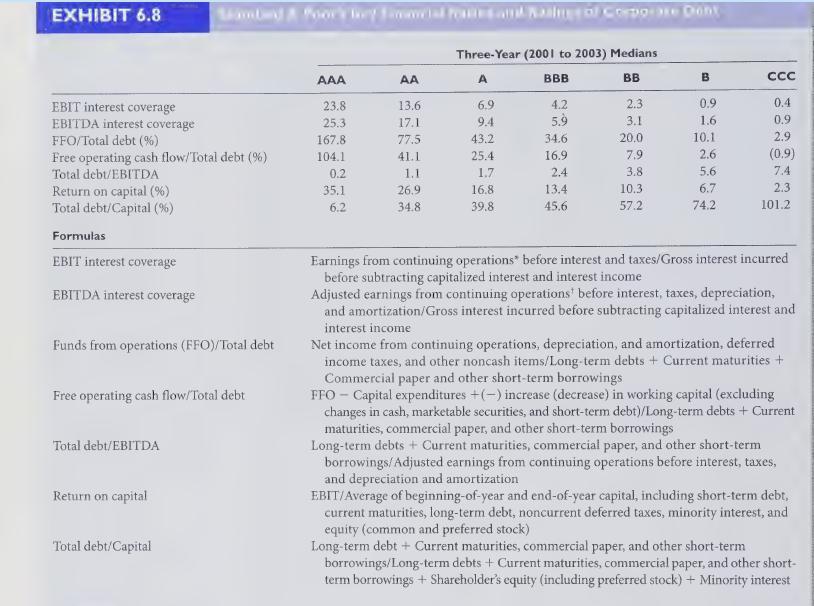

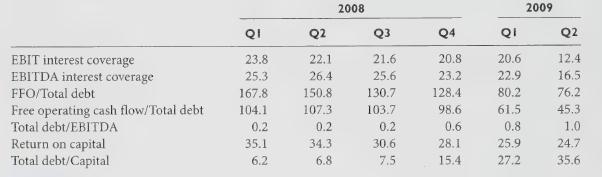

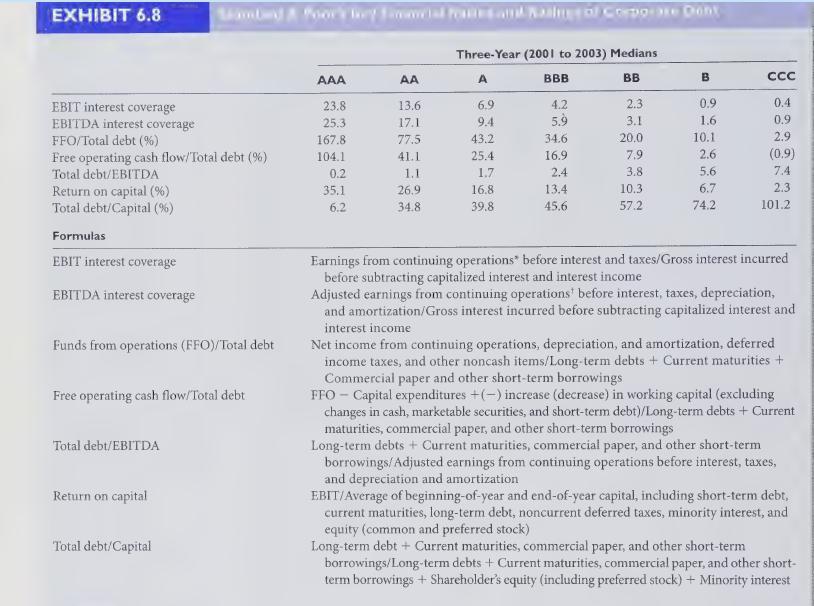

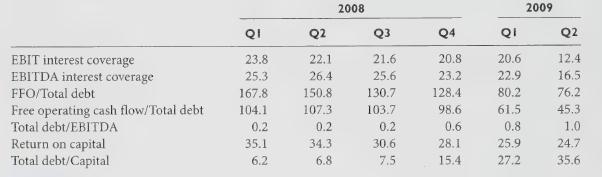

Exhibit 6.8 describes the key financial ratios that Standard & Poor's analysts use to assess credit risk and assign credit ratings to industrial companies. Those same financial ratios for a single company over time follow. The company was assigned a AAA credit rating at the beginning of 2008.

Required:

1. Did the company’s credit risk increase or decrease over these six quarters?

2. What credit rating should be assigned to the company as of Q2 in 2009?

3. In what quarter should the company’s credit rating be downgraded from AAA?

Transcribed Image Text:

EXHIBIT 6.8 Sambad & Poor's toy finial Poses and Rasing of Corpo ase Dont Three-Year (2001 to 2003) Medians AAA AA A BBB BB B CCC EBIT interest coverage 23.8 13.6. 6.9 4.2 2.3 0.9 0.4 EBITDA interest coverage 25.3 17.1 9.4 5.9 3.1 1.6 0.9 FFO/Total debt (%) 167.8 77.5 43.2 34.6 20.0 10.1 2.9 Free operating cash flow/Total debt (%) 104.1 41.1 25.4 16.9 7.9 2.6 (0.9) Total debt/EBITDA 0.2 1.1 1.7 2.4 3.8 5.6 7.4 Return on capital (%) 35.1 26.9 16.8 13.4 10.3. 6.7 2.3 Total debt/Capital (%) 6.2 34.8 39.8 45.6 57.2 74.2 101.2 Formulas EBIT interest coverage EBITDA interest coverage Funds from operations (FFO)/Total debt Free operating cash flow/Total debt Total debt/EBITDA Return on capital Total debt/Capital Earnings from continuing operations" before interest and taxes/Gross interest incurred before subtracting capitalized interest and interest income Adjusted earnings from continuing operations' before interest, taxes, depreciation, and amortization/Gross interest incurred before subtracting capitalized interest and interest income Net income from continuing operations, depreciation, and amortization, deferred income taxes, and other noncash items/Long-term debts + Current maturities + Commercial paper and other short-term borrowings FFO - Capital expenditures +(-) increase (decrease) in working capital (excluding changes in cash, marketable securities, and short-term debt)/Long-term debts + Current maturities, commercial paper, and other short-term borrowings Long-term debts + Current maturities, commercial paper, and other short-term borrowings/Adjusted earnings from continuing operations before interest, taxes, and depreciation and amortization EBIT/Average of beginning-of-year and end-of-year capital, including short-term debt, current maturities, long-term debt, noncurrent deferred taxes, minority interest, and equity (common and preferred stock) Long-term debt + Current maturities, commercial paper, and other short-term borrowings/Long-term debts + Current maturities, commercial paper, and other short- term borrowings + Shareholder's equity (including preferred stock) + Minority interest