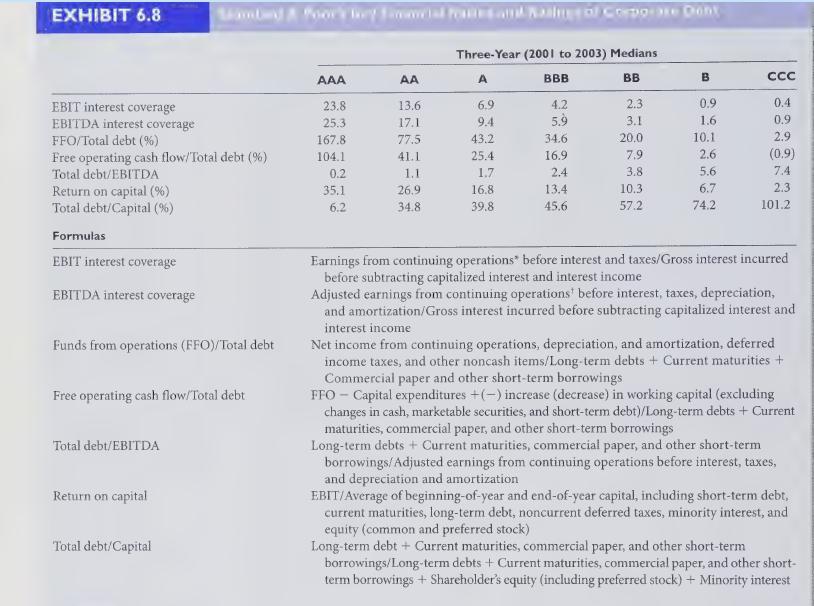

Exhibit 6.8 describes the key financial ratios that Standard & Poor's analysts use to assess credit risk

Question:

Exhibit 6.8 describes the key financial ratios that Standard & Poor's analysts use to assess credit risk and assign credit ratings to industrial companies.

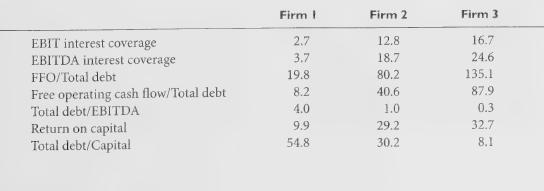

The same financial ratios for three firms follow.

Required:

1. What credit rating would be assigned to Firm 1?

2. What credit rating would be assigned to Firm 2?

3. Does Firm 3 have more or less credit risk than Firm 2? How can you tell?

Transcribed Image Text:

EXHIBIT 6.8 Sambad & Poor's toy finial Poses and Rasing of Corpo ase Dont Three-Year (2001 to 2003) Medians AAA AA A BBB BB B CCC EBIT interest coverage 23.8 13.6. 6.9 4.2 2.3 0.9 0.4 EBITDA interest coverage 25.3 17.1 9.4 5.9 3.1 1.6 0.9 FFO/Total debt (%) 167.8 77.5 43.2 34.6 20.0 10.1 2.9 Free operating cash flow/Total debt (%) 104.1 41.1 25.4 16.9 7.9 2.6 (0.9) Total debt/EBITDA 0.2 1.1 1.7 2.4 3.8 5.6 7.4 Return on capital (%) 35.1 26.9 16.8 13.4 10.3. 6.7 2.3 Total debt/Capital (%) 6.2 34.8 39.8 45.6 57.2 74.2 101.2 Formulas EBIT interest coverage EBITDA interest coverage Funds from operations (FFO)/Total debt Free operating cash flow/Total debt Total debt/EBITDA Return on capital Total debt/Capital Earnings from continuing operations" before interest and taxes/Gross interest incurred before subtracting capitalized interest and interest income Adjusted earnings from continuing operations' before interest, taxes, depreciation, and amortization/Gross interest incurred before subtracting capitalized interest and interest income Net income from continuing operations, depreciation, and amortization, deferred income taxes, and other noncash items/Long-term debts + Current maturities + Commercial paper and other short-term borrowings FFO - Capital expenditures +(-) increase (decrease) in working capital (excluding changes in cash, marketable securities, and short-term debt)/Long-term debts + Current maturities, commercial paper, and other short-term borrowings Long-term debts + Current maturities, commercial paper, and other short-term borrowings/Adjusted earnings from continuing operations before interest, taxes, and depreciation and amortization EBIT/Average of beginning-of-year and end-of-year capital, including short-term debt, current maturities, long-term debt, noncurrent deferred taxes, minority interest, and equity (common and preferred stock) Long-term debt + Current maturities, commercial paper, and other short-term borrowings/Long-term debts + Current maturities, commercial paper, and other short- term borrowings + Shareholder's equity (including preferred stock) + Minority interest

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Answer rating: 100% (1 review)

Answered By

Rinki Devi

Professional, Experienced, and Expert tutor who will provide speedy and to-the-point solutions.

Hi there! Are you looking for a committed, reliable, and enthusiastic tutor? Well, teaching and learning are more of a second nature to me, having been raised by parents who are both teachers. I have done plenty of studying and lots of learning on many exciting and challenging topics. All these experiences have influenced my decision to take on the teaching role in various capacities. As a tutor, I am looking forward to getting to understand your needs and helping you achieve your academic goals. I'm highly flexible and contactable. I am available to work on short notice since I only prefer to work with very small and select groups of students.

I have been teaching students for 5 years now in different subjects and it's truly been one of the most rewarding experiences of my life. I have also done one-to-one tutoring with 100+ students and helped them achieve great subject knowledge.

5.00+

2+ Reviews

10+ Question Solved

Related Book For

Question Posted:

Students also viewed these Business questions

-

1. Summary of controls you have built into your system. It might help to reflect back on the Intro to AIS Course and an Auditing course for this section 2.How record layouts were affected by...

-

Exhibit 6.5 describes the key financial ratios Standard & Poors analysts use to assess credit risk and assign credit ratings to industrial companies. The same financial ratios for three firms follow....

-

Exhibit 6.5 describes the key financial ratios Standard & Poors analysts use to assess credit risk and assign credit ratings to industrial companies. The same financial ratios for three firms follow....

-

Three partners. Ankamah, Kofi and David share profit and losses in the ratio 5: 3:2 for the year ending 31/12/2016. The profit generated from either business is $600,000. Partners' contributions are...

-

Which of the following compounds is chiral? a. 1-bromo-1-phenylethane b. 1-bromo-2-phenylethane

-

As the promotional manager for a new line of cosmetics targeted to preteen girls, you have been assigned the task of deciding which promotional mix elements - advertising, public relations, sales...

-

Please list two ways a company can take care of their employees. LO.1

-

The following additional information is available for the Dr. Ivan and Irene Incisor family from Chapters 1 and 2. On September 1, Irene opened a retail store that specializes in sports car...

-

Skysong, Inc. purchased a new machine on October 1, 2022 at a cost of $124,800. The company estimated that the machine has a salvage value of $9,600. The machine is expected to be used for 96,000...

-

Exhibit 6.8 describes the key financial ratios that Standard & Poor's analysts use to assess credit risk and assign credit ratings to industrial companies. Those same financial ratios for a single...

-

Figure 6.6 in this chapter illustrates the behavior of stock returns over the period before a quarterly earnings announcement (from trading days 60 to 1); at the time of an earnings announcement (on...

-

26 APV, FTE and WACC Lone Star Industries has just issued 160,000 of perpetual 10 per cent debt and used the proceeds to repurchase equity. The company expects to generate 75,000 of earnings before...

-

Q.9 Prepare a cash flow statement using the indirect method based on the following information: - Net Income: $150,000 - Depreciation Expense: $20,000 - Increase in Accounts Receivable: $10,000...

-

3.11 (a) Find the order of the elements 2, 7, 10 and 12 in F17. (b) Find the order of the elements a, a, a + 1 and a3 + 1 in F16, where a is a root of 1+x+x4.

-

You have been recently hired to lead a Project to relocate your main Distribution Centre (DC) from Calgary, Alberta to St. John's, Newfoundland. As the Project Manager, try to complete a project plan...

-

Males Mean: 69.6 Standard Deviation: 11.3 For males, find P90, which is the pulse rate separating the bottom 90% from the top 10%.

-

Statistics Assignments Using Excel Assignment #4: Measures of Variability Part I Below are ACT composite scores from 20 randomly selected college students. 15 33 20 25 21 24 17 16 20 25 26 21 21 17...

-

Can someone have a successful career by aspiring to be an effective follower? Explain.

-

Calculate the change in entropy when 100 kJ of energy is transferred reversibly and isothermally as heat to a large block of copper at (i) 0 C, (ii) 50 C.

-

The market price of a stock is $24.55 and it is expected to pay a dividend of $1.44 next year. The required rate of return is 11.23%. What is the expected growth rate of the dividend? Submit Answer...

-

Suppose Universal Forests current stock price is $59.00 and it is likely to pay a $0.57 dividend next year. Since analysts estimate Universal Forest will have a 13.8 percent growth rate, what is its...

-

ABC Company engaged in the following transaction in October 2 0 1 7 Oct 7 Sold Merchandise on credit to L Barrett $ 6 0 0 0 8 Purchased merchandise on credit from Bennett Company $ 1 2 , 0 0 0 . 9...

Study smarter with the SolutionInn App