First Solar, Inc., adopted the new revenue recognition standard, ASC Topic 606, in 2017. The following are

Question:

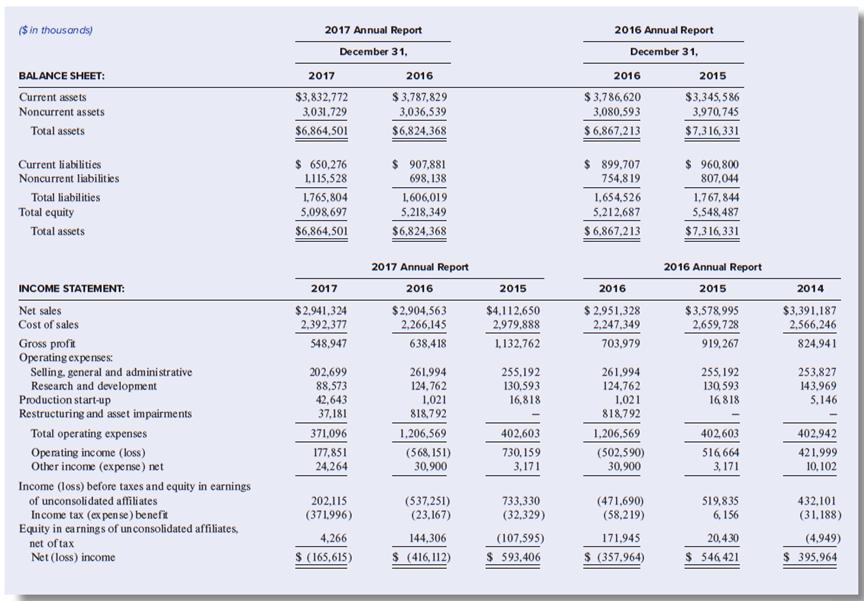

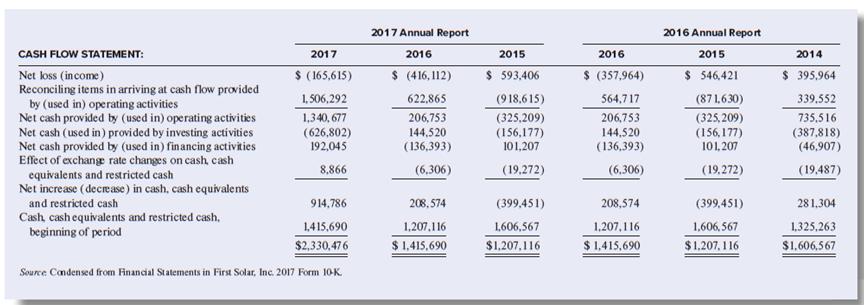

First Solar, Inc., adopted the new revenue recognition standard, ASC Topic 606, in 2017. The following are condensed versions of First Solar’s balance sheet, income statement, and cash flow statement, as they were presented in the company’s 2017 annual report, alongside the same financial statements as presented in the company’s 2016 annual report.

Required:

1. Did First Solar use retroactive restatement or the cumulative effect approach when it adopted ASC Topic 606? Explain how you can make that determination from the information provided.

2. Reconstruct the journal entry First Solar used at January 1, 2017, when it adopted ASC Topic 606.

3. What is the most reasonable way to compute a sales growth percentage for 2017 versus 2016?

4. Explain why net cash provided by (used in) operating activities is unchanged from the 2016 report to the 2017 report (for 2016 and 2015) even as net income changes. Your explanation should be more in depth than just noting that the reconciling items also change and result in the same cash flow amount. Why is that the case?

($ in thousands) 2017 Annual Report 2016 Annu al Report December 31, December 31, BALANCE SHEET: 2017 2016 2016 2015 $3.832,772 3.031.729 $6.864,501 $3,787,829 3,036,539 $6,824.368 Current assets Noncurrent assets $3,786,620 $3,345, 586 3,080.593 $ 6,867,213 3.970,745 $7.316,331 Total assets $ 650,276 1,115,528 $ 899,707 Current liabilities $ 907,881 $ 960,800 Noncurrent liabilities 698, 138 754,8 19 807,044 1,765,804 1,654,526 5.212,687 Total liabilities 1,606,019 1,767, 844 Total equity 5,548,487 5.098.697 $6,864.501 5,218,349 $6824,368 $ 6,867,213 $7.316,331 Total assets 2017 Annual Report 2016 Annual Report INCOME STATEMENT: 2017 2016 2015 2016 2015 2014 $ 2.951.328 2,247,349 $2.941,324 $4.112.650 Net sales Cost of sales $2.904,563 $3.578,995 2,659,7 28 $3.391,187 2,566,246 2,392,377 2,266,145 2,979.888 Gross profit Operating expenses: Selling, general and administrative Research and development Production start-up Restructuring and asset impairments 548,947 638,4 18 1,132,762 703,979 919,267 824,941 202,699 88,573 42,643 37,181 261,994 255,192 261,994 255, 192 253,827 124, 762 1,021 818,792 130,593 16,818 124,762 1,021 818,792 130, 593 16818 143,969 5,146 Total operating expenses 371,096 1,206,569 402,603 1,206,569 402603 402,942 (502,590) 30,900 730, 159 Operating income (loss) Other income (expense) net 177,851 24,264 (568, 151) 30,900 516 664 3, 171 421,999 10, 102 3,171 Income (loss) before taxes and equity in carnings of unconsolidated affiliates Income tax (ex pen se) benefit Equity in carnings of unconsolidated affiliates, net of tax 733,330 (32,329) 202,115 (537,251) (23,167) (471,690) (58,219) 519,835 6, 156 432,101 (31,188) (371.996) 4,266 144,306 (107,595) 171,945 20,430 (4,949) Net (loss) income $ (165,615) $ (416, 112) $ 593,406 $ (357.964) $ 546 421 $ 395,964

Step by Step Answer:

Requirement 1 When comparing amounts presented for 2016 in the 2016 annual report to amounts presented for 2016 in the 2017 annual report it is clear that the financial statements have been changed Th...View the full answer

Financial Reporting And Analysis

ISBN: 9781260247848

8th Edition

Authors: Lawrence Revsine, Daniel Collins, Bruce Johnson, Fred Mittelstaedt, Leonard Soffer

Students also viewed these Business questions

-

1. Discuss trends in First Solars revenue streams. For more information about First Solars results, you may want to consult the Management Discussion and Analysis in its Form 10-K for 2017, available...

-

The Hydrogenics case is the first in a series of four cases that illustrate a comprehensive analysis of an international corporation. In this case the balance sheet will be analyzed with the income...

-

The consolidated balance sheets of Gap Inc. included merchandise inventory in the amount of $1,625 as of January 30, 2016 (the end of fiscal year 2015) and $1,615 as of January 31, 2015 (the end of...

-

It can be seen that in rolling a strip, the rolls will begin to slip if the back tension, b is too high. Derive an analytical expression for the magnitude of the back tension in order to make the...

-

In Table 2-11 we have data on CPI and the S&P 500 index for the years 1990 to 2007. CONSUMER PRICE INDEX (CPI) AND S&P 500 INDEX (S&P), UNITED STATES, 1990-2007 a. Repeat questions (a) to (e) from...

-

Confidence level: Each student tosses both a penny and a nickel 50 times each and constructs a 90%, a 95%, and a 99% confidence interval for the difference in the proportion of heads. How many of the...

-

22. What are the three sections of a CAFR? Briefly identify the contents of each section.

-

The following letter was sent to the SEC and the FASB by leaders of the business community. Dear Sirs: The FASB has been struggling with accounting for derivatives and hedging for many years. The...

-

please help Polaski Company manufactures and sells a single product called a Ret. Operating at capacity, the company can produce and sell 36,000 Rets per year. Costs associated with this level of...

-

The implementations of the methods addAll, removeAll, retainAll, toArray(), and toArray(T[]) are omitted in the MyList interface. Implement these methods. Test your new MyList class using the code at...

-

In 20X2, the new CEO of Watsontown Electric Supply became concerned about the companys apparently deteriorating financial position. Wishing to make certain that the grim monthly reports he was...

-

Trubisky Corporation acquired a machine on January 1, 20X1, for $3 million and decided to depreciate it over eight years using the double-declining method. The depreciation rate each year, as a...

-

Free Flying Aviation (FFA) just declared a 20 percent stock dividend to be paid three weeks from today. Before the payment of the stock dividend, the equity section on FFAs balance sheet appeared as...

-

Most research indicates that good leaders exhibit these leadership skills / https://emeritus.org/blog/leadership-skills-for-managers/ Which of these skills, in your opinion, are the most difficult to...

-

Consider the following account balances (in thousands) for the Shaker Corporation In the Dec 31.2021 Cash $200,000 and Capital $2,000,000 and Retained earnings $1,500,000 The balances of raw...

-

Given: a = -7,b=-519, c = < 5,-1,9 >,d= 2j - 4k, e = < 4, -6, -3> F = 6 -[312].G=124 -91 2x1 Determine the following if possible and if not possible explain why not. i. a ii. |c| iii. |F| iv. V. F-1...

-

I have been identified and approached by leaders who saw my potential and asked me to apply for a position. I was humbled and honored to be identified and I accepted the invitation. It has led to...

-

the object is 2.0mm?there are two converging lens on the right side of the object?one is 9.9cm far away from the object and has a focal point 9.0cm?the other is 101.1cm far away from the first lens...

-

Determine whether the taxpayer in each of the following situations has a claim of right to the income received: a. Sulleys Spa Spot sells hot tubs that have a 2-year warranty. The warranty provides...

-

What kind of financial pressures can an LBO cause?

-

Following your retirement as senior vice president of finance for a large company, you joined the board of Cayman Grand Cruises, Inc. You serve on the compensation committee and help set the bonuses...

-

Duke Energy Corporation's 2014 annual report to shareholders contains the following note disclosure (edited for brevity): Regulatory Accounting A substantial majority of Duke Energy's regulated...

-

Margaret Magee has served both as an outside director to Maxcor Manufacturing since 2010 and as a member of the company's compensation committee since 2014. Margaret has been reviewing Maxcor's 2017...

-

Domino is 4 0 years old and is married out of community of property with the exclusion of the accrual system to Dolly ( 3 5 ) . They have one child, Domonique, who is 1 1 years old. Domino resigned...

-

YOU ARE CREATING AN INVESTMENT POLICY STATEMENT FOR JANE DOE General: 60 years old, 3 grown children that are living on their own and supporting themselves. She is in a very low tax rate so we don't...

-

firm purchased a new piece of equipment with an estimated useful life of eight years. The cost of the equipment was $65,000. The salvage value was estimated to be $10,000 at the end of year 8. Using...

Study smarter with the SolutionInn App