Flower Company started doing business on January 1, 2007. For the year ended December 31, 2008, it

Question:

Flower Company started doing business on January 1, 2007. For the year ended December 31, 2008, it reported \($450,000\) pre-tax book income on its income statement. Flower is subject to a 40% corporate tax rate for this year and the foreseeable future. Additionally, it has the following issues that impact its tax situation:

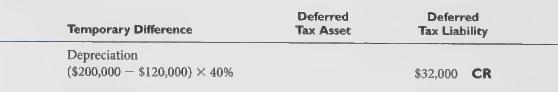

1. During 2008, Flower acquired \($600,000\) of specialized productive machinery that it depreciates using the straight-line method over five years with no salvage value for accounting purposes. For tax purposes, this specialized equipment is being depreciated \($200,000\) per year for the first three years of its productive life.

2. During 2008, the federal government fined Flower \($100,000\) for violating environmental |

laws. The amount was paid on November 15, 2008 and was deducted in determining this year’s book income.

3. Flower received \($40,000\) of interest revenue as a result of its investment in the bonds issued by the State of Arizona.

4. On January 2, 2008, Flower leased warehouse space for \($2,000\) per month for a three-year period. On January 2, 2008, as a condition of the lease, Flower paid \($30,000\) to the lessor to cover the first 15 months of rent. Because Flower leased space in excess of its needs, it immediately (January 2, 2008) subleased part of the warehouse to a small, local company.

The sublease was also for a period of three years and required the tenant to make \($800\) monthly rent payments to Flower. During 2008, Flower received \($8,800\) in monthly rental payments from the sublessee. Pre-tax book income includes an accrual for rent revenue earned but not yet received in cash.

5. During the year, Flower’s CEO was killed in an automobile accident. The company had a \($200,000\) life insurance policy on the CEO and collected the proceeds of the policy during October 2008.

6. During 2008, Flower sold a parcel of land held for speculative purposes. The historical cost of the land was \($320,000\), and it was sold for \($680,000\). The cash will be collected from the purchaser in 10 monthly installments of \($68,000\) each. During 2008, Flower collected five of these \($68,000\) payments; the remaining payments are assumed to be fully collectible during 2009.

7. During 2007, Flower accumulated \($22,000\) operating loss carryforward it can use to offset 2008 taxable income.

8. The beginning balance in the Deferred income tax asset account is \($8,800\) and there was no beginning balance in the Deferred income tax liability account.

Required:

1. Beginning with pre-tax accounting income, compute taxable income and taxes payable for 2008. Clearly label all amounts used in arriving at taxable income.

2. Using the following schedule, compute the change in the Deferred tax asset and Deferred tax liability accounts for 2008. The depreciation temporary difference has been completed as an example.

3. Determine tax expense for 2008.

Step by Step Answer: