In Year 1, Phillips Company reported ($10,000) net income for both book and tax purposes. It incurred

Question:

In Year 1, Phillips Company reported \($10,000\) net income for both book and tax purposes. It incurred a \($1,000\) book expense that it deducted on its tax return. Assuming a 35% tax rate, this deduction results in a \($350\) tax benefit. The tax law was unclear at that time whether this expense was deductible, so it led to an uncertain tax position.

In Year 1, this uncertain tax position had a 60% likelihood of being sustained based on technical merits, \($150\) of the benefit was recognized, and a tax contingency reserve of \($200\) was created for this position.

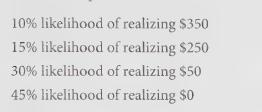

A court decision in Year 2 lowered the likelihood that this uncertain tax position could be sustained on technical merits to 40% and led to the following amounts and related individual probabilities of possible outcomes:

Required:

1. Based on these facts, provide the journal entry that Phillips would make in Year | to record tax expense, taxes payable, and the tax contingency for unrecognized tax benefits.

No Provide the entry Phillips would make in Year 2 to record any change in the status of the tax contingency reserve.

Step by Step Answer: