LVMH Group is a French company that specializes in luxury brands in 5 industry segments. The Wine

Question:

LVMH Group is a French company that specializes in luxury brands in 5 industry segments.

The Wine and Spirits segment includes Hennessy, Chateau d’Yquem, Veuve Clicquot, Moét &

Chandon, Dom Pérignon, and Mercier. The Fashion and Leather Goods segment includes such companies as Louis Vuitton, Fendi, Celine, Givenchy, and Thomas Pink. The Perfumes and Cosmetics segment includes Parfums Christian Dior, Guerlain, Parfums Givenchy, and Kenso. TAG Heuer, Zenith, and Fred are part of its Watches and Jewelry segment. Its final segment, Selective Retailing, contains DFS, Sephora, and Le Bon Marché.

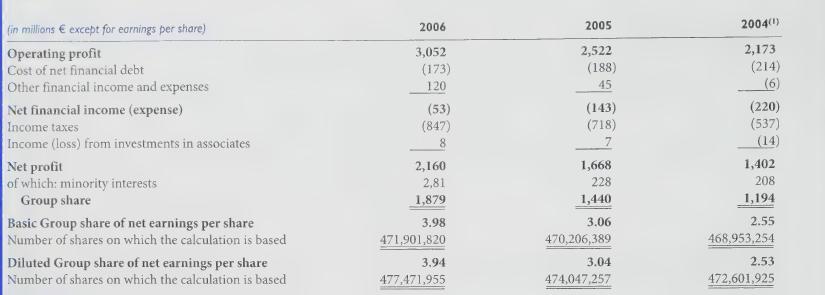

LVMH Group uses IFRS. The purpose of this case is to provide you with an opportunity to use your understanding of U.S. GAAP and IFRS along with logic and intuition to familiarize yourself with some oft he differences between these two sets of standards. The income statement, balance sheet, and statement of changes in equity of LVMH Group follow on the next two pages.

Required:

1. Some of LVMH Group’s terminology and account titles differ from U.S. usage. Under U.S.

GAAP, what would the following LVMH Group balance sheet accounts be called? You may also wish to refer to the statement of changes in equity.

a. Share capital

b. Share premium account

c. Revaluation reserves

d. Group share of net profits

e. Provisions (long term and short term)

2. Explain how the format of the balance sheet differs from that of U.S. balance sheets.

3. Both the income statement and balance sheet contain amounts related to “Investments in associates.’ Explain the nature of these investments and which accounting method is being used to account for them.

4. Refer to the statement of changes in equity. For 2006, the statement shows a decrease to “Cumulative translation adjustment” of € (411) million and an increase to “Revaluation reserves” of €259 million. What are the changes in and cumulative amounts of these accounts called under U.S. GAAP?

5. Based on your review of the balance sheet and the statement of changes in equity, what items might be expected to affect the “Revaluation reserves”? Consider the nature of LVMH Group’s main subsidiaries.

6. Explain whether all of the items identified as affecting LVMH Group's “Revaluation reserves”

in question 5 would be allowed under U.S. GAAP.

Step by Step Answer: