Mack Company is a European subsidiary of Bear Down Corporation, a U.S. company. Mack had the following

Question:

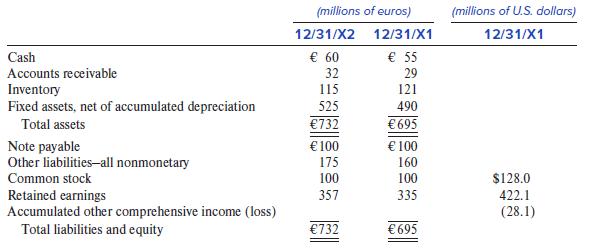

Mack Company is a European subsidiary of Bear Down Corporation, a U.S. company. Mack had the following balance sheets at December 31, 20X2, and December 31, 20X1.

Also provided above are the U.S. dollar amounts that appeared in Mack’s translated balance sheet at December 31, 20X1, for common stock, retained earnings, and accumulated other comprehensive income (loss). Mack did not issue or repurchase any shares in 20X2. It also did not pay any dividends, so the €22 million increase in retained earnings between balance sheet dates is explained entirely by 20X2 net income. All transactions resulting in the recognition of revenue or expense in 20X2 occurred evenly throughout the year. There are no differences between local GAAP and U.S. GAAP for Mack. Bear Down translates Mack’s financial statements using the current rate method. The euro was worth $1.13 at December 31, 20X2. The average exchange rate for 20X2 was $1.17.

Required:

1. What is the amount of net income in Mack’s 20X2 U.S. dollar income statement?

2. What is the amount of cash in Mack’s December 31, 20X2, U.S. dollar balance sheet?

3. What is the amount of inventory in Mack’s December 31, 20X2, U.S. dollar balance sheet?

4. What is the amount of common stock in Mack’s December 31, 20X2, U.S. dollar balance sheet?

5. What is the amount of retained earnings in Mack’s December 31, 20X2, U.S. dollar balance sheet?

6. What is the amount of accumulated other comprehensive income or (loss) in Mack’s December 31, 20X2, U.S. dollar balance sheet?

Step by Step Answer:

Financial Reporting And Analysis

ISBN: 9781260247848

8th Edition

Authors: Lawrence Revsine, Daniel Collins, Bruce Johnson, Fred Mittelstaedt, Leonard Soffer