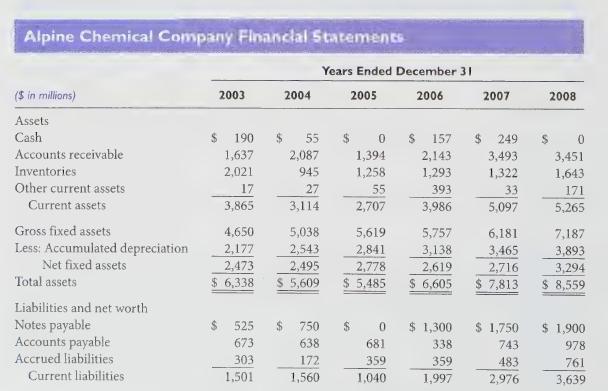

Margaret O'Flaherty, a portfolio manager for MCF Investments, is considering investing in Alpine Chemical 7% bonds, which

Question:

Margaret O'Flaherty, a portfolio manager for MCF Investments, is considering investing in Alpine Chemical 7% bonds, which mature in 10 years. She asks you to analyze the company to Analyzing ratios determine the riskiness of the bonds.

Required:

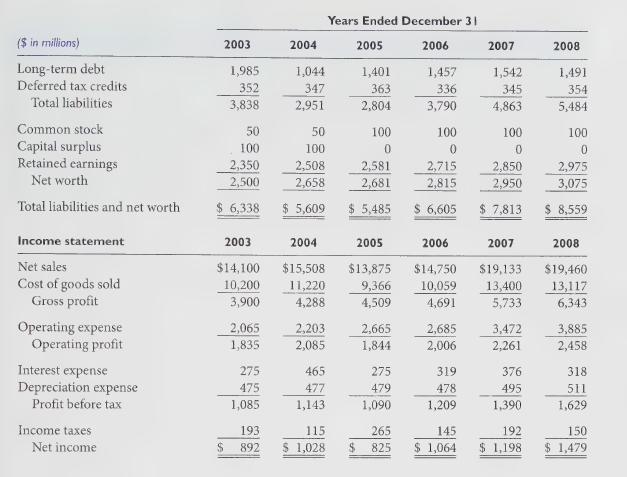

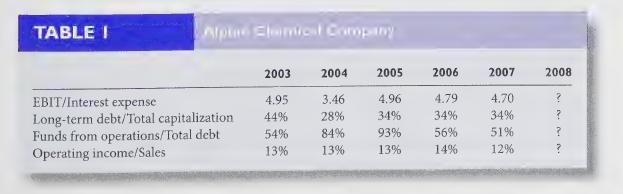

1. Using the data provided in the accompanying financial statement, calculate the following ratios for Alpine Chemical for 2008:

a. EBIT/Interest expense

b. Long-term debt/Total capitalization

c. Funds from operations/Total debt

d. Operating income/Sales Use the following conventions: EBIT is earnings before interest and taxes; Total capitalization is interest-bearing long-term debt plus net worth; Funds from operations means net income plus depreciation expense; and Total debt includes interest-bearing short-term and long-term debt.

2. Briefly explain the significance of each ratio calculated in requirement | to the assessment of Alpine Chemical’s creditworthiness.

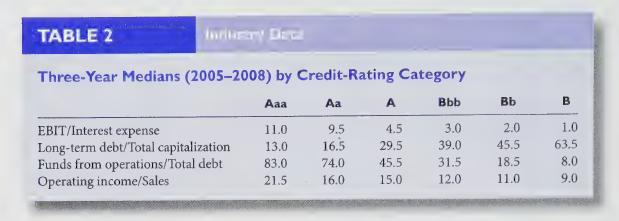

3. Insert your answers to requirement | into Table 1 that follows. Then from Table 2 on the next page, select an appropriate credit rating for Alpine Chemical.

Step by Step Answer: