Maytag Corporation manufactures and distributes a broad line of home appliances including gas and electric ranges, dishwashers,

Question:

Maytag Corporation manufactures and distributes a broad line of home appliances including gas and electric ranges, dishwashers, refrigerators, freezers, laundry equipment, and vacuum cleaning products. The home appliance segment contributes about 87% of Maytag’s total sales.

The company’s other two segments are commercial appliances and international appliances, both of which have been scaled back over the last three years. Roughly 89% of Maytag’s sales come from North American markets.

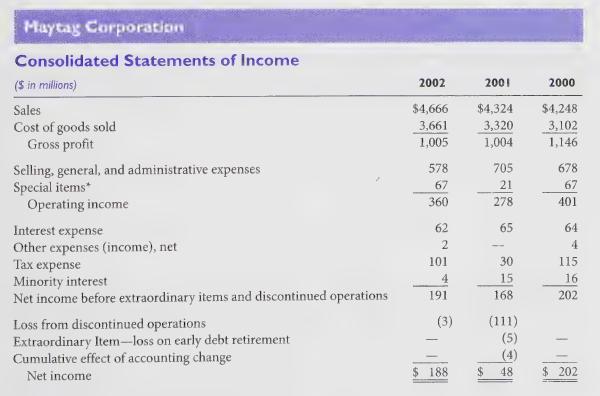

Refer to Maytag’s 2002 financial statements. Consolidated sales increased 1.8% from 2000 to 2001 and 7.9% from 2001 to 2002. Earnings varied considerably over these years with net income falling from \($201\) million in 2000 to \($48\) million in 2001 and then rebounding to \($188\) million in 2002. Whirlpool, a competitor, acquired Maytag in 2006.

Required:

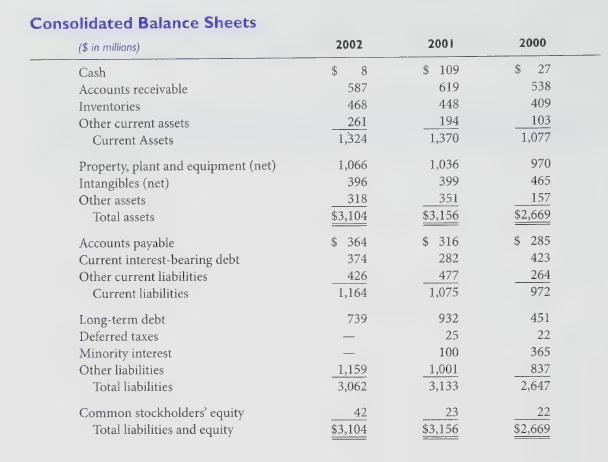

Prepare an analysis of Maytag’s profitability for 2002, 2001, and 2000 using the four steps below. For all ratios requiring balance sheet values, use the average of beginning and ending balances. Base ratios using earnings numbers on net income before extraordinary items. Use “adjusted” rather than “as reported” earnings and balance sheet numbers where appropriate.

Assume a 35% tax rate.

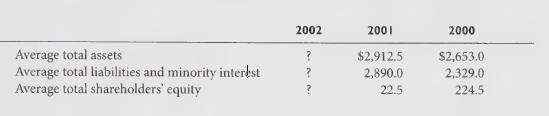

Step : Calculate average total assets, liabilities, and stockholders’ equity for 2002.

Step 2: Calculate Maytag’s ROA for each year. Use margin and turnover analysis with common-size income statements to explain the year-to-year change in ROA.

Step 3: What after-tax interest rate has Maytag been paying for its debt? Analyze the portion of average total assets that Maytag has been financing with debt over the three year period and comment on any apparent strategy.

Step 4: Calculate Maytag’s ROCE for each year. Has leverage benefited Maytag shareholders?

How can you tell?

Step by Step Answer: