Mill Company began operations on January 1, 2008 and recognized income from constructiontype contracts under the percentage-of-completion

Question:

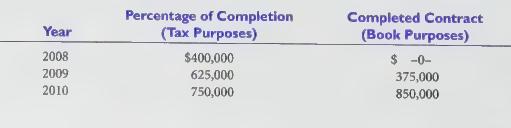

Mill Company began operations on January 1, 2008 and recognized income from constructiontype contracts under the percentage-of-completion method for tax purposes and the completed-contract method for financial reporting purposes. Information concerning income recognition under each method is as follows:

Required:

For all years, assume that the income tax rate is 40% and that Mill has no other timing differences.

In its December 31, 2010 balance sheet, Mill should report deferred income taxes of how much? Indicate whether the amount is an asset or a liability.

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Question Posted: