National Coal Corporation mines, processes, and sells high-quality bituminous steam coal from mines located in Tennessee and

Question:

National Coal Corporation mines, processes, and sells high-quality bituminous steam coal from mines located in Tennessee and southeastern Kentucky. The company owns the coal mineral rights to approximately 74,600 acres of land and leases the rights to approximately 40,900 additional acres. National Coal has expanded its operations considerably since commencing operations at a single surface mine in Tennessee in July 2003.

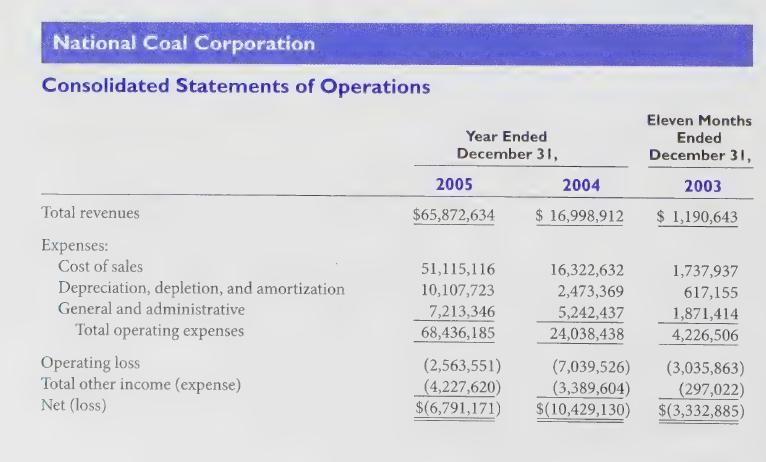

The following information is excerpted from National Coal Corporation's 2005 annual report to shareholders.

Property, Plant, Equipment and Mine Development Property and equipment are stated at cost. Maintenance and repairs that do not improve efficiency or extend economic life are expensed as incurred. Plant and equipment are depreciated using the straight-line method over the estimated useful lives of assets which generally range from seven to thirty years for building and plant and one to five years for equipment. On sale or retirement, asset cost and related accumulated depreciation are removed from the accounts and any related gain or loss is reflected in income.

The Company periodically reviews the estimated useful lives of its fixed assets. During the second quarter of 2005, this review indicated that the estimated useful lives for certain asset categories were generally determined to be less than those employed in calculating depreciation expense. As a result, the Company revised the estimated useful lives of mining equipment as of the beginning of the second quarter.

Depreciation, Depletion, Accretion and Amortization Expense The increase in depreciation, depletion, accretion and amortization expense in the twelve-month period ended December 31, 2005 compared to the twelve-month period ended December 31, 2004 is primarily attributable to a 493.3% increase in depreciation. This change was due to the acquisition of \($19.3\) million of fixed assets, primarily mining equipment, and a change in the estimated useful lives of our mining equipment. On April 1, 2005, we changed our policy for the depreciable life of mining equipment to three to five years from seven years. Subsequently, most of our equipment was estimated to have a three-year useful life. This had the impact of increasing depreciation on mining equipment by approximately \($3.6\) million during 2005. This adjustment was treated as a change in accounting estimate and depreciation expense was adjusted on a prospective basis.

Required:

1. Calculate the impact of the depreciation policy change on National Coal’s 2005 net income (loss). Consider the effects of income taxes in your answer.

2. How will the change affect National Coal’s reported earnings over the next few years?

3. How might a financial analyst determine whether the change National Coal made is reasonable in light of industry conditions?

4. How might firms use depreciation policy changes to manage their earnings? Is there anything to prevent rampant use of depreciation policy changes as a tool to manage reported earnings?

5. In light of contracting issues discussed in Chapter 7, speculate as to the possible reasons National Coal made the change in its depreciation policy.

Step by Step Answer: