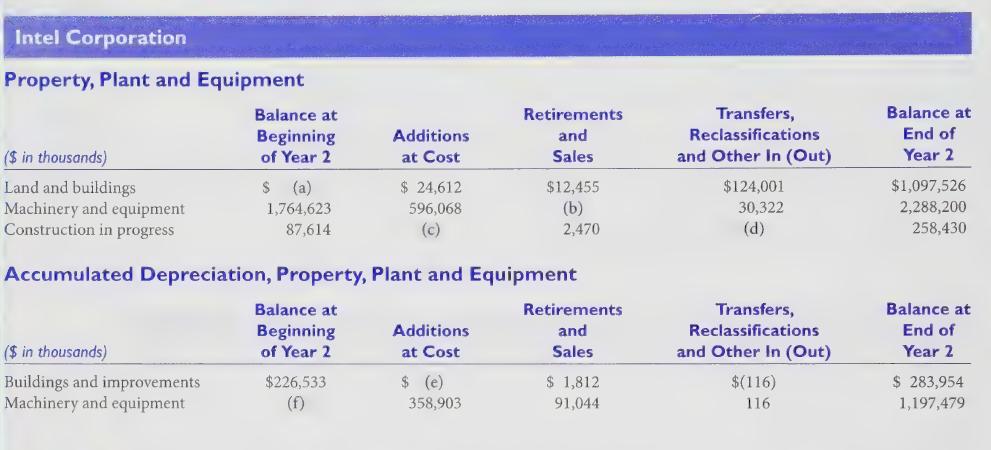

On the following page is information pertaining to the Property, plant, and equipment accounts of Intel Corporation.

Question:

On the following page is information pertaining to the Property, plant, and equipment accounts of Intel Corporation. This information was taken from Intel’s Year 2 10-K report. A 10-K is an annual report that firms must file with the SEC within 90 days of the end of their fiscal year. (All figures are in thousands.)

Additional Information:

All amounts under the heading Retirements and Sales are retirements.

Required:

1. Solve for the unknowns in Intel’s Property, Plant, and Equipment and Accumulated Depreciation schedules for Year 2.

2. What was the total amount expended on the acquisition of new property, plant, and equipment in Year 2? Where would this amount appear in the financial statements?

3. What was the net gain (or net loss) reported in Year 2 on the retirement of property, plant, and equipment? Where would this amount appear in the financial statements?

4, Make all the journal entries related to the Property, plant, and equipment and Accumulated depreciation accounts for Year 2.

5. Prepare a schedule of the depreciation expense to be taken for financial reporting purposes on the new machinery and equipment acquired in Year 2. Prepare separate schedules assuming straight-line, sum-of-the-years’ digits, and double-declining balance. Assume a zero salvage value for all assets and a three-year useful life; also assume that Intel takes a full year of depreciation in the year an asset is purchased.

6. Assume that one of Intel’s long-term debt contracts requires Intel to maintain a minimum interest coverage ratio of 5.0. If Intel’s interest coverage ratio falls below 5.0, the lenders have the option to require immediate payment of their debt or renegotiate the interest rate. Assume that Intel’s interest coverage ratio at the end of Year | was 4.9.

Briefly describe how the restriction on the firm's interest coverage ratio could affect management's choice of depreciation policy for all or some of the new long-term assets acquired in Year 2.

7. What other settings in which management may be tempted to use depreciation policy strategically to influence the numbers reported in the financial statements can you identity?

8. Identify other items in the financial statements (in addition to depreciation expense) that _ management is capable of “managing,” Are some easier for outside parties to observe?

9. Several years ago, the SEC decided to stop requiring firms to report the detailed information about the underlying changes in the long-term asset and accumulated depreciation accounts that appear in the following two schedules. As a financial analyst, do you approve or disapprove?

Explain why.

Step by Step Answer: