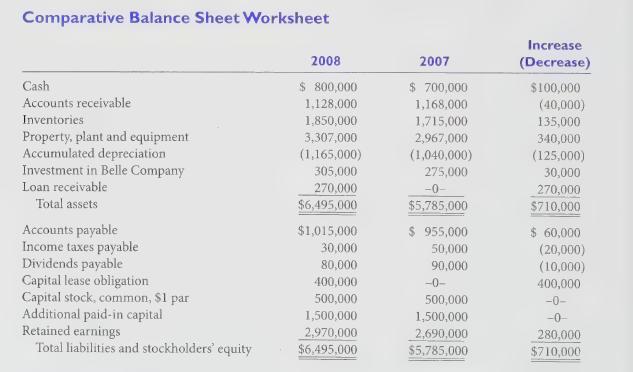

Omega Corporation's comparative balance sheet accounts worksheet at December 31, 2008 and 2007 follow with a column

Question:

Omega Corporation's comparative balance sheet accounts worksheet at December 31, 2008 and 2007 follow with a column showing the increase (decrease) from 2007 to 2008.

Additional Information:

• On December 31, 2007, Omega acquired 25% of Belle Company’s common stock for \($275,000\). On that date, the carrying value of Belle’s assets and liabilities, which approximated their fair values, was \($1,100,000\). Belle reported income of \($120,000\) for the year ended December 31, 2008. No dividend was paid on Belle’s common stock during the year.

• During 2008, Omega loaned \($300,000\) to Chase Company, an unrelated company.

Chase made the first semiannual principal repayment of \($30,000\) plus interest at 10%, on October 1, 2008.

• On January 2, 2008, Omega sold equipment for \($40,000\) cash that cost \($60,000\) and had a carrying amount of \($35,000\).

• On December 31, 2008, Omega entered into a capital lease for an office building. The present value of the annual rental payments is \($400,000\), which equals the building’s fair value. Omega made the first rental payment of \($60,000\), when due, on January 2, 2009.

• Net income for 2008 was \($360,000\).

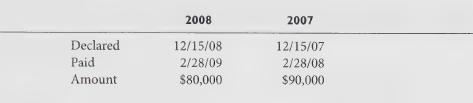

• Omega declared and paid cash dividends for 2008 and 2007 as follows:

Required:

Prepare a statement of cash flows for Omega Corporation for the year ended December 31, 2008 using the indirect approach.

Step by Step Answer: