The financial statements of Cavalier Toy Stores (a fictitious merchandising company) follow: Required: 1. Prepare a statement

Question:

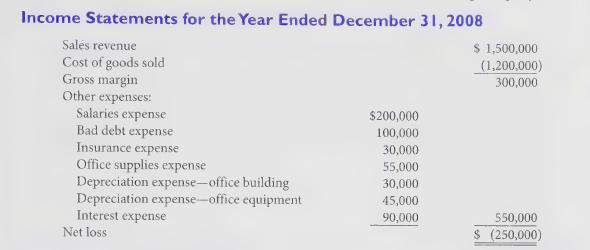

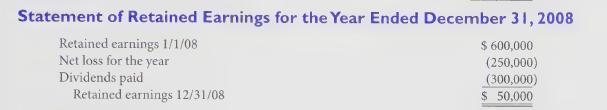

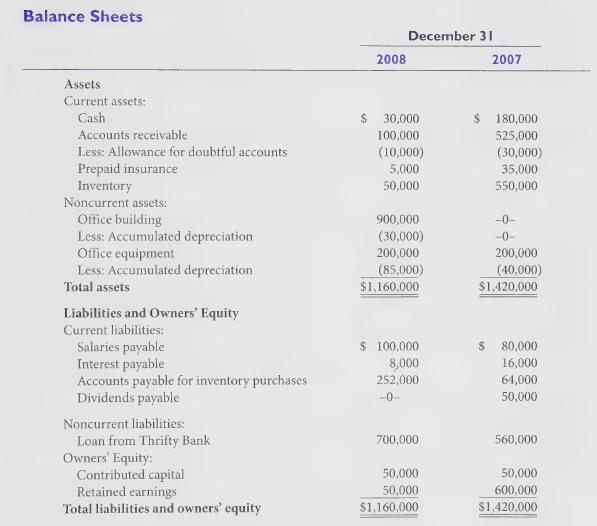

The financial statements of Cavalier Toy Stores (a fictitious merchandising company) follow:

Required:

1. Prepare a statement of cash flows using the indirect method.

2. Compute the following for the year ended December 31, 2008:

a. Bad debts written off during the year.

b. Cash collected from customers.

c. Purchases of inventory made during the year.

d. Cash paid to suppliers for inventory purchases.

e. Cash paid for insurance.

3. The following is an excerpt from the chief executive officer’s letter to the stockholders included in the annual reports of Cavalier Toy Stores:

It feels real good to finish 2008 and be thankful that your company achieved its best year ever.

I am sure that you are all puzzled by my statement given the net loss we have reported in the income statement. Let me explain. Although our gross margin has declined from last year’s because of competitive pressures, we have set a company record in terms of sales revenue. You know quite well how accounting income can be manipulated. We don't play that game. We let cash flows tell our success story. Also, we have very efficiently managed our receivables and inventory and, at the same time, taken advantage of all available credit from our suppliers.

More importantly, I am sure all of you are very pleased with the dividends that you have received this year. Let me end this letter by proudly inviting you to visit our new executive office building. While touring the luxurious executive suites, please remember that your top management team did not burden you with one dollar of debt to buy this building.

Assume that you are a commercial lending officer at Thrifty Bank. The working capital loan given to Cavalier Toy Stores has a balance outstanding as of December 31, 2008 of \($700,000\) and is repayable by April 1, 2009. The CEO has sent a loan proposal to Thrifty Bank requesting renewal of the loan for one more year and an increase in the credit limit to \($1,000,000\). Your job is to write a report to your boss with a specific recommendation on whether to accept or reject the proposal. Base your recommendation on the information available to you. In your report, please consider all of the CEO’s claims in the letter to stockholders.

Step by Step Answer: