On June 17, Year 2, Sears, Roebuck, and Company acquired Lands End. Sears income statements and balance

Question:

On June 17, Year 2, Sears, Roebuck, and Company acquired Lands’ End. Sears’ income statements and balance sheets have been condensed from the Year 2 annual report. Sears disclosed the acquisition in Note 2, and disclosed the effect of implementing SFAS No. 142 in Note 17.

Note 2—Acquisition On June 17, Year 2, the Company acquired 100 percent of the outstanding common shares of Lands’

End. The results of Lands’ End’s operations have been included in the consolidated financial statements since that date. Headquartered in Dodgeville, Wisconsin, Lands’ End is a leading direct merchant of traditionally styled, casual clothing for men, women and children, accessories, footwear, home products and soft luggage.

The Company acquired Lands’ End for \($1.8\) billion in cash. The acquisition has been accounted for using the purchase method in accordance with SFAS No. 141, “Business Combinations.” Accordingly, the total purchase price has preliminarily been allocated to the assets acquired and liabilities assumed based on their estimated fair values at acquisition as follows (amounts in millions):

Of the \($704\) million acquired intangibles, \($700\) million was assigned to registered tradenames that are not subject to amortization and \($4\) million was assigned to customer lists with an estimated useful life of three years.

The amount allocated to goodwill is reflective of the benefit the Company expects to realize from leveraging the Lands’ End brand name across its retail business. The goodwill related to the Lands End acquisition is not deductible for tax purposes.

Note |7—Implementation of New Accounting Standard Effective at the beginning of Year 2, the Company adopted SFAS No. 142, “Goodwill and Other Intangible Assets.” Upon adoption of SFAS No. 142, goodwill amortization ceased. Goodwill is now subject to fair-value based impairment tests performed, at a minimum, on an annual basis. In addition, a transitional goodwill impairment test is required as of the adoption date. These impairment tests are conducted on each business of the Company where goodwill is recorded, and may require two steps. The initial step is designed to identify potential goodwill impairment by comparing an estimate of fair value for each applicable business to its respective carrying value. For those businesses where the carrying value exceed fair value, a second step is performed to measure the amount of goodwill impairment in existence, if any.

The Company had approximately \($371\) million in positive goodwill and \($77\) million in negative goodwill recorded in its consolidated balance sheet at the beginning of Year 2 as well as approximately \($104\) million in positive goodwill related to an equity method investment which is not subject to SFAS No. 142 impairment tests. The \($77\) million in negative goodwill was required to be recognized into income upon adoption of the Statement. The Company completed the required transitional goodwill impairment test in the first quarter of Year 2 and determined that \($261\) million of goodwill recorded within the Company’s Retail and Related Services segment, primarily related to NTB and Orchard Supply Hardware, was impaired under the fair value impairment test approach required by SFAS No, 142.

The fair value of these reporting units was estimated using the expected present value of associated future cash flows and market values of comparable businesses where available. Upon adoption of the Statement, a \($208\) million charge, net of tax and minority interest, was recognized in the first quarter of Year 2 to record this impairment as well as the recognition of negative goodwill and was classified as a cumulative effect of a change in accounting principle.

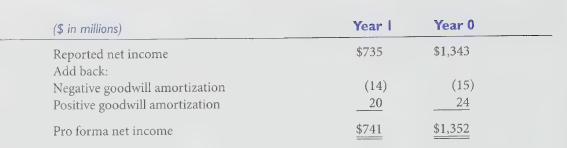

The following table presents the pro forma effect of the adoption of SFAS No. 142 on recent fiscal periods as if the change was applied at the beginning of the respective fiscal year:

The Company’s policy is to test the realizability of goodwill as of the end of the fiscal year. The Company tested the realizability of the \($944\) million of goodwill as of December 28, Year 2 resulting in no additional impairment being recorded.

Required:

1. What amount did Sears allocate to goodwill in the Lands’ End acquisition? Provide possible reasons that Sears paid this premium to purchase Lands’ End.

2. How does Sears account for this goodwill under SFAS No. 142? How would Sears have accounted for this goodwill under pre-SFAS No. 142 rules?

3. How will the change in goodwill accounting affect Sears’ income in future years?

4. Based on the disclosures, explain the change in Sears’ reported goodwill on its balance sheet from Year 1 and Year 2.

5. Note 2 states that the acquired tradenames are not subject to amortization, but the acquired customer lists are amortized over three years. Explain the different accounting treatments for these two acquired intangible assets.

Step by Step Answer: