City Holding Company is a multibank holding company headquartered in West Virginia. The Company is comprised of

Question:

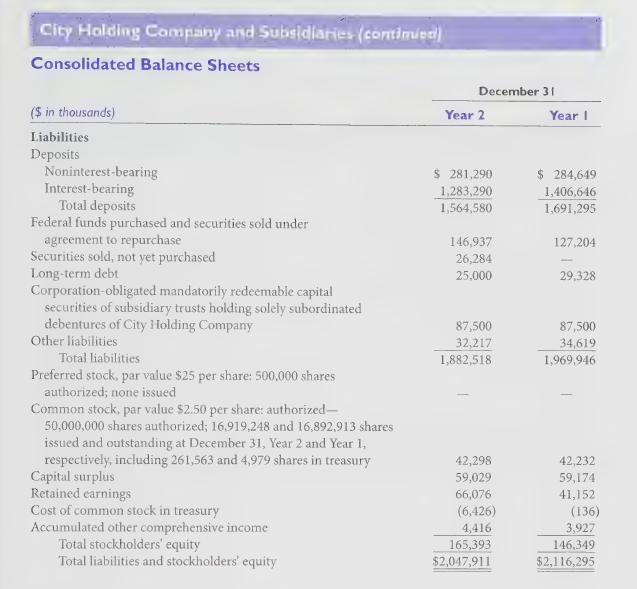

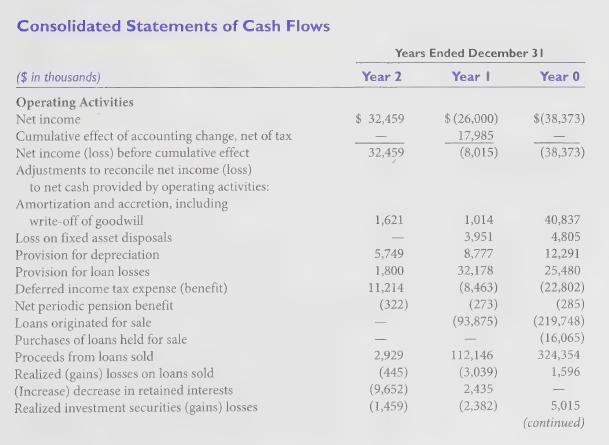

City Holding Company is a multibank holding company headquartered in West Virginia. The Company is comprised of multiple facilities located in West Virginia, Ohio, and California. The banking subsidiaries provide a full range of banking services and make investments in debt and equity securities under limitations and restrictions imposed by regulations of the Comptroller of the Currency. Appearing on the following pages are City Holding Company's consolidated balance sheet and cash flow statement as well as selected footnote information pertaining to the available- for-sale securities for Year 2 and Year 1. Using the information provided, determine responses to the questions that follow. Provide detailed support where appropriate. (Note: Unrealized gains [losses] on available-for-sale securities are not recognized for tax pur- poses until the securities are sold. Accordingly, the tax effects of these unrealized gains [losses] are recognized as adjustments to the deferred tax liability [asset] accounts. Unrealized gains [losses] on available-for-sale securities are shown net of related tax effects as an adjustment to stockholders' equity. Assume that the all realized gains and losses reported in the footnote on page 1001 relate to available-for-sale securities. Transfers of securities from the held-to-maturity to available-for-sale category are recorded at fair value with the unrealized gain [loss] recorded in stockholders' equity.)

Required:

1. Determine the net before-tax unrealized holding gain (loss) on available-for-sale securities that City Holding recognized in Year 2. Assume no adjustments are made to the unrealized holding gain (loss) account when securities are sold.

2. Assuming a 35% tax rate, determine the deferred tax amounts related to the net unrealized holding gains (losses) that were recorded in Year 2. Indicate whether the deferred tax amounts were a liability or an asset.

3. Give the entry that City Holding made at December 31, Year 2 to record the unrealized gain (loss) on available-for-sale securities and to adjust the related stockholders’ equity account.

4. Give the entry that City Holding made to record sales and calls on available-for-sale securities in Year 2.

5. To the extent possible, explain the year-to-year change in the cost basis of the available for-

sale securities (from \($377,013,000\) on December 31, Year 1 to \($436,070,000\) on December 31, Year 2).

Notes to Consolidated Financial Statements City Holding Company and Subsidiaries Note Four: Investments During Year 2, the Company initiated an investment strategy to invest in trust preferred securities issued by other financial institutions. Only those securities issued by financial institutions that satisfy various asset size, profitability, equity-to-asset ratio, and certain other criteria, as pre-established by management, are evaluated for potential investment. Securities acquired were predominantly investment grade or were reviewed and approved for investment by the Company’s executive loans committee. As of December 31, Year 2, the Company had invested \($40.75\) million, classified as held-to-maturity, and \($17.43\) million, classified as available-for-sale, pursuant to this strategy.

Also during Year 2, the Company transferred debt securities debt securities with an estimated fair value of \($37.14\) million and an amortized cost basis of \($36.03\) million from the available-for-sale classification to the held-to-maturity category. Transfers of debt securities into the held-to-maturity category from the available-for-sale classification are made at fair value at the date of transfer. The unrealized holding gain of \($1.11\) million at the date of transfer is retained in the other comprehensive income section of stockholders’ equity and in the carrying value of the held-to-maturity securities. Such amount are amortized over the remaining life of the security.

The aggregate carrying and approximate market values of securities follow. Fair values are based on quoted market prices, where available. If quoted market prices are not available, fair values are based on quoted market prices of comparable financial instruments.

Gross gains of \($1.46\) million were realized during Year 2 on sales and calls of securities. There were no gross losses realized during Year 2. Gross gains of \($2.67\) million and \($105,000\) and gross losses of \($290,000\) and \($5.12\) million were realized on sales and calls of securities during Year 1 and Year 0, respectively. Of the gross gains reported in Year 2, \($1.35\) million was directly attributable to two interest rate risk management processes utilized during the year. First, the Company reported \($0.62\) million in gains realized from the Company’s investment in a mutual fund that generates capital gains, as opposed to interest income. Second, as further discussed in Note Five, the Company reported \($0.73\) million in gains realized from an investment transaction that entailed the short-sale of a high-coupon U.S. Treasury bond. Gross gains of \($2.67\) million in Year 1 include \($1.62\) million of gains realized from the Company's investment in a mutual fund during Year 1.

The Company maintained an average balance of \($46.25\) million invested in the mutual fund during Year 1.

This mutual fund generated capital gains, as opposed to interest income, which utilized capital loss carryforwards available to the Company for income tax purposes. The capital loss carryforwards were primarily generated by the gross securities losses recognized in Year 0. Gross losses of \($5.12\) million in Year 0 are comprised of losses the Company recognized on its investments in small business investment corporations.

The book value of securities pledged to secure public deposits and for other purposes as required or |

permitted by law approximated \($158.11\) million and \($260\) million at December 31, Year 2 and Year 1, respectively.

Step by Step Answer: