Selected financial statements for Ralston Company, a sole proprietorship, are as follows: Balance Sheet as of December

Question:

Selected financial statements for Ralston Company, a sole proprietorship, are as follows:

Balance Sheet as of December 31, 20X0 | |

Assets: | |

Cash | $ 30,000 |

Equipment | 36,000 |

Accumulated depreciation: equipment | (11,250) |

Leased property | 18,000 |

Total assets | $ 72,750 |

Liabilities and owner’s equity: | $ 18,000 |

Lease liability | 54,750 |

Ralston, capital | $ 72,750 |

Total liabilities and owners’ equity | $ 30,000 |

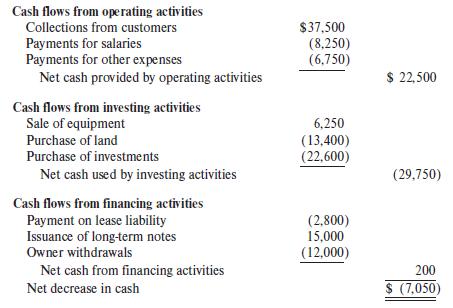

Statement of Cash Flows for the Year Ended December 31, 20X1

Additional Information:

a. During 20X1, equipment having accumulated depreciation of $4,500 was sold for a $4,000 gain.

b. A $3,550 lease payment was made in 20X1, reducing the lease liability by $2,800.

c. 20X1 depreciation expense: on leased property, $3,100; on equipment, $8,250.

d. Net income for 20X1 was $15,150.

Required:

Using the provided data, prepare Ralston’s December 31, 20X1, balance sheet.

Step by Step Answer:

Financial Reporting And Analysis

ISBN: 9781260247848

8th Edition

Authors: Lawrence Revsine, Daniel Collins, Bruce Johnson, Fred Mittelstaedt, Leonard Soffer