Slough Estates is a U.K.-based property developer with holdings of investment properties in the United Kingdom, France,

Question:

Slough Estates is a U.K.-based property developer with holdings of investment properties in the United Kingdom, France, Germany, United States, and Canada. The company prepares its financial statements based on annual revaluations of its property portfolio, which are allowed under IFRS.

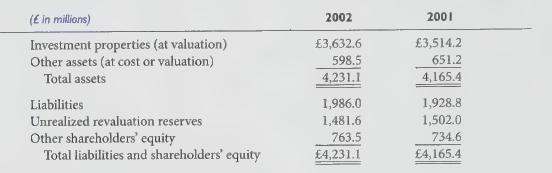

Information from Slough Estates’ balance sheets for 2002 and 2001 include the following data:

Net income plus after-tax interest was approximately £136.7 million in 2002. The company also disclosed that the historical cost basis of the investment properties portfolio was £2,141.6 million and £1,999.5 million in 2002 and 2001, respectively. Despite this large difference, historical cost net income would have been essentially the same as the amount reported in the table, which was computed on a current cost basis.

Required:

1. Calculate Slough Estates’ 2002 return on assets based on the company’s published profit and loss statement and balance sheets.

2. Recalculate this ratio assuming that Slough Estates had used historical cost accounting.

Which ratio would you prefer to use when analyzing the company?

3. Real estate companies commonly use revaluation accounting for their property portfolios when accounting standards permit this treatment. Speculate on reasons for this behavior.

Step by Step Answer: