China Petroleum and Chemical Corporation (Sinopec) is a large integrated Chinese petroleum and petrochemical company. Its shares

Question:

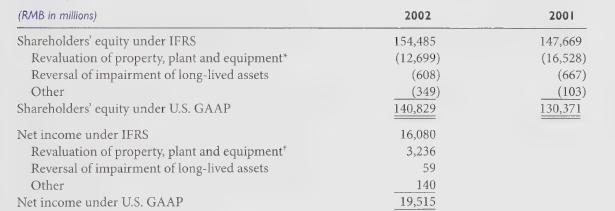

China Petroleum and Chemical Corporation (Sinopec) is a large integrated Chinese petroleum and petrochemical company. Its shares are listed on the Shanghai Stock Exchange as well as exchanges in Hong Kong, New York, and London. The company prepares two full sets of financial statements using China's accounting rules and IFRS, as well as a reconciliation of its IFRS accounts to U.S. GAAP. A summary of the reconciliation between IFRS and U.S. GAAP follows in renminbi (RMB) currency.

Required:

1. Identify various approaches that companies can use to make their financial statements more understandable to foreign investors. What approaches has Sinopec used?

2. IFRS permits the revaluation of property, plant and equipment and reversals of impairment charges on long-lived fixed assets. These accounting differences cause IFRS shareholders’

equity to be overstated relative to U.S. GAAP. However, as indicated in the income reconciliation, they also cause IFRS net income to be understated relative to USS.

GAAP. Explain why IFRS standards in this case cause opposite directional adjustments to the balance sheet (decreasing U.S. GAAP equity) and the income statement (increasing U.S. GAAP income).

3. What is Sinopec’s return on equity (ROE) when it reports under IFRS? What is the company’s ROE under U.S. GAAP? Which measure do you prefer? Explain.

Step by Step Answer: