At the end of 2002, Portugal Telecom (PT) and Telefnica, the Spanish telecom company, formed Brasilcel, a

Question:

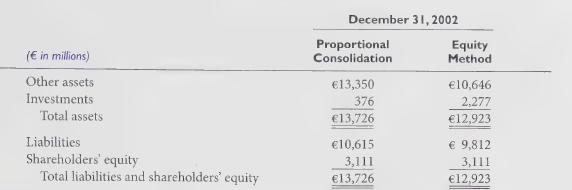

At the end of 2002, Portugal Telecom (PT) and Telefénica, the Spanish telecom company, formed Brasilcel, a 50:50 joint venture that provides mobile phone service to the Brazilian market. Under Portuguese GAAP, PT must account for this joint venture using the proportional consolidation method. Proportional consolidation requires PT to include 50% of Brasilcel’s assets and liabilities in its balance sheet. Under U.S. GAAP, PT would have accounted for its investment in Brasilcel using the equity method.

PT is listed on the New York Stock Exchange, so the company files a Form 20-F with the U.S.

SEC. The 2002 20-F provided a comparison of PT’s actual balance sheet showing the Brasilcel joint venture under the proportional consolidation method with a pro forma balance sheet accounting for Brasilcel using the equity method. Both balance sheets, which follow, were prepared using identical accounting principles except for the treatment of the joint venture.

Required:

1. Why is shareholders’ equity equal under the two methods while assets and liabilities are larger under the proportional consolidation method?

2. Using PT as an example, discuss how the application of proportional consolidation might affect an investor's perceptions of a company’s financial leverage and return on assets. For simplicity, assume that PT’s net income plus after-tax interest was €695 in 2002 under both methods.

Step by Step Answer: