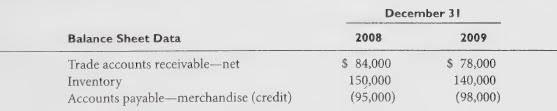

The following data have been extracted from the financial statements of Prentiss, Inc., a calendar- Rae |

Question:

The following data have been extracted from the financial statements of Prentiss, Inc., a calendar- Rae |

year merchandising corporation:

• ‘Total sales for 2009 were \($1,200,000\) and for 2008 were \($1,100,000\). Cash sales were 20% of total sales each year.

• Cost of goods sold was \($840,000\) for 2009.

• Variable general and administrative (G&A) expenses for 2009 were \($120,000\). These expenses have varied in proportion to sales and have been paid at the rate of 50% in the year incurred and 50% the following year. Unpaid G&A expenses are not included in accounts payable.

• Fixed G&A expenses, including \($35,000\) depreciation and \($5,000\) bad debt expense, totaled \($100,000\) each year. The amount of such expenses involving cash payments was paid at the rate of 80% in the year incurred and 20% the following year. In each year, there was a \($5,000\) bad debt estimate and a \($5,000\) write-off. Unpaid G&A expenses are not included in accounts payable.

Required:

Compute the following:

1. The amount of cash collected during 2009 that resulted from total sales in 2008 and 2009.

2. The amount of cash disbursed during 2009 for purchases of merchandise.

3. The amount of cash disbursed during 2009 for variable and fixed G&A expenses.

Step by Step Answer: