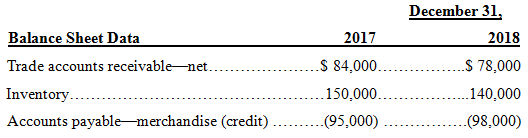

The following data have been extracted from the financial statements of Prentiss, Inc., a calendar-year merchandising corporation:

Question:

The following data have been extracted from the financial statements of Prentiss, Inc., a calendar-year merchandising corporation:

• Total sales for 2018 were $1,200,000 and for 2017 were $1,100,000. Cash sales were 20% of total sales each year.

• Cost of goods sold was $840,000 for 2018.

• Variable general and administrative (G&A) expenses for 2018 were $120,000. These expenses are the same proportion of sales every year, and have been paid at the rate of 50% in the year incurred and 50% the following year. Unpaid G&A expenses are not included in accounts payable.

• Fixed G&A expenses, including $35,000 depreciation and $5,000 bad debt expense, totaled $100,000 each year. The amount of such expenses involving cash payments was paid at the rate of 80% in the year incurred and 20% the following year. In each year, there was a $5,000 bad debt estimate and a $5,000 write-off. Unpaid G&A expenses are not included in accounts payable.

Required:

Compute the following:

1. The amount of cash collected during 2018 that resulted from total sales in 2017 and 2018.

2. The amount of cash disbursed during 2018 for purchases of merchandise.

3. The amount of cash disbursed during 2018 for variable and fixed G&A expenses.

Financial StatementsFinancial statements are the standardized formats to present the financial information related to a business or an organization for its users. Financial statements contain the historical information as well as current period’s financial...

Step by Step Answer:

Financial Reporting and Analysis

ISBN: 978-1259722653

7th edition

Authors: Lawrence Revsine, Daniel Collins, Bruce Johnson, Fred Mittelstaedt, Leonard Soffer