The following information is drawn from recent annual reports of three firms in the retail industry: JC

Question:

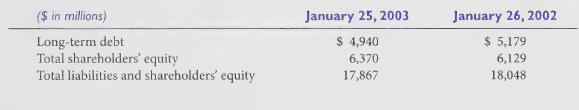

The following information is drawn from recent annual reports of three firms in the retail industry: JC Penney Company, Inc., Dillard Department Stores, Inc., and Macy's Inc. A. JC Penney is a major retailer operating 1,049 department stores in 49 states, Puerto Rico, and Mexico. In addition, it operates 54 Renner department stores in Brazil. A major portion of JC Penney Company's business consists of providing merchandise and services to consumers through department stores, catalog departments, and the Internet. Selected financial informa- tion follows:

An excerpt from its lease footnote follows:

The Company conducts the major parts of its operations from leased premises that include retail stores,

catalog fulfillment centers, warehouses, offices, and other facilities. Future minimum lease obligations as

of January 25, 2003, were:

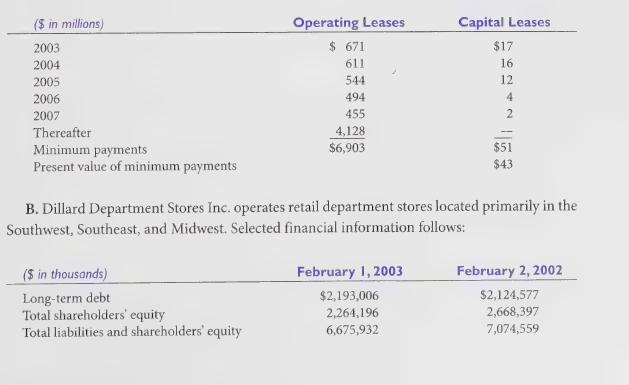

An excerpt from its lease footnote follows:

Future minimum payments under capital leases and the future minimum rental commitments for all

noncancelable operating leases as of February 1, 2003 are as follows ($ in thousands):

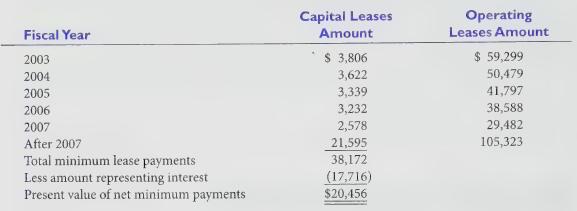

C. Macy’s, Inc. (formerly, Federated Department Stores Inc.) is one of the leading operators

of full-line department stores in the United States with more than 850 department stores in

45 states. The company’s department stores are located at urban or suburban sites, principally in densely populated areas across the United States. Selected financial information follows:

Additional Information:

1. For JC Penney, assume that the operating lease payments due after 2007 are equal and will

be made over a 10-year period.

2. For Dillard's, assume that the operating lease payments due after 2007 are equal and will

be made over a five-year period.

3. For Macy's, assume that the operating lease payments due after 2007 are equal and will be

made over a 14-year period.

Required:

1. Show that the interest rate implicit in the capital lease obligations of JC Penney is closer to

8.5% than to 10%.

2. Using the 8.5% rate from requirement 1, calculate the present value of JC Penney’s operating

lease obligations.

3. Using the approach followed in requirement 1, we can determine that the interest rate

inplicati n Dillard's capital lease obligations is close to 10%. Use this rate to calculate the

presem value of the firmis operating lease payments.

4 The approach in requirement 1 allows us to determine that the interest rate implicit in

Wh

Macys capital lease obligations Macy's is dose to 11.5%. Use this rate to calculate the

present value of the firms operating lease payments.

. Using the balance sheet information reported earlier, calculate the long-term debt to

sharcholders equity ratio and the long-term debt to total assets ratio of the three firms for

theis most recent fiscal year.

. Repeat requirement 5 after treating the operating leases as if they are being accounted for

2s capital leases. How do the results compare with those in requirement 5? (Ignore taxes

and assume that the capitalized asset equthea calpitaslize d liability.)

Step by Step Answer: