The following information is based on an actual annual report. In a recent lending agreement (dated March

Question:

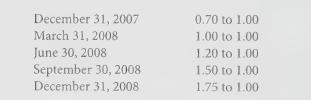

The following information is based on an actual annual report. In a recent lending agreement (dated March 3, 2008), Guaraldi Bank, Inc., included the following definitions for terms used in its loan covenants with a borrower: Fixed Charges means the sum of, for Borrower and its Subsidiaries, determined in accordance with GAAP on a consolidated basis, (a) interest expense (including interest expense pursuant to Capital Leases), plus (b) lease expense payable for Operating Leases, determined for the four fiscal quarters pre- ceding the date of calculation. Net Earning Available for Fixed Charges means, for Borrower and its Subsidiaries, determined in accordance with GAAP on a consolidated basis, (a) Net Income before Taxes, plus (b) extraordinary noncash charges, plus (c) interest expense (including interest expense pursuant to Capital Leases), plus (d) lease expense pursuant to Operating Leases, determined for the fiscal quarter preceding the date of calculation. Fixed Charges Coverage Ratio means the ratio of Net Earnings Available for Fixed Charges to Fixed Charges. Borrower shall not permit the Fixed Charges Coverage Ratio to be less than the following ratios for the fiscal quarters ending as follows:

Notice that the definitions of Fixed charges and Net earnings available for fixed charges both

add back lease expenses under operating leases. The objective of this case is to allow you to see

why astute lenders carefully design covenants to protect themselves against borrowers who

might use the latitude in GAAP lease accounting rules to circumvent covenant restrictions.

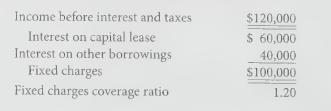

Assume the following initial conditions for the borrower on June 30, 2008:

Notice that the fixed charges coverage ratio equals the covenant constraint at June 30, 2008;

even minor adversity might cause a covenant violation in the next quarter. In addition, the

borrower is required to increase the ratio to 1.50 by September 30, 2008.

Required:

1. Assume that the borrower “somehow” restructures the existing lease to have it qualify as

an operating lease. What effect will this change in lease classification have on the timesinterest-

earned ratio as typically defined? (See Chapter 5.) What effect will this change

have on the fixed charges coverage ratio as defined in the lending agreement? What does

your answer to this part tell you about the vigilance that credit analysts must exert in

designing and monitoring financial contractual restrictions?

2. Now assume that the initial times-interest-earned ratio was less than 1.00 to 1.00. Would

changing the capital lease to an operating lease benefit the borrower’s compliance with

lending covenants?

(Note: In answering both parts, make assumptions when sufficient information is not

available.)

Step by Step Answer: