Wal-Mart Stores, Inc. operates retail stores in various retailing formats in all 50 states in the United

Question:

Wal-Mart Stores, Inc. operates retail stores in various retailing formats in all 50 states in the United

States. The company’s mass merchandising operations serve its customers primarily through the

operation of three segments. The Wal-Mart Stores segment includes its discount stores, Supercenters,

and Neighborhood Markets in the United States. The SAM’s Clubs segment includes the

warehouse membership clubs in the United States. The International segment includes all of its operations in Argentina, Brazil, Canada, China, Japan, Germany, Korea, Mexico, Puerto Rico, and

the United Kingdom. The company’s subsidiary, McLane Company, Inc. provides products and

distribution services to retail industry and institutional foodservice customers.

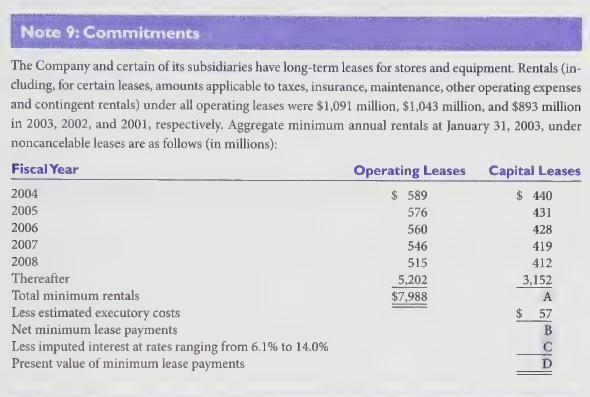

Information taken from Wal-Mart's fiscal year 2003 annual report follows:

Required:

1. Solve for the unknowns (A, B, C, and D) in Note 9.

2. Make the journal entry to account for Wal-Mart’ fiscal year 2004 capital lease payment.

(Ignore allocating the executory cost portion because there is insufficient information to

do so.)

3, Assume that the amount of Wal-Mart's operating lease payment due each year after 2008

is equal and is paid at the end of each fiscal year. Assume that all of these leases terminate

at the end of 2019. Using an interest rate of 8%, calculate the present value of the operating

lease payments at January 31, 2003.

4. Make the journal entry that would be necessary at January 31, 2003 to account for the

operating leases as if they were being treated as capital leases. (Ignore income taxes and

assume that the amount of the capitalized asset equals the capitalized liability.)

5. Based on your answer to requirement 3, make the necessary journal entries for the fiscal

year ended January 31, 2004 assuming operating leases are being accounted for as capital

leases. Assume a 16-year useful life, zero salvage value, and straight-line depreciation for

all capitalized leased assets. :

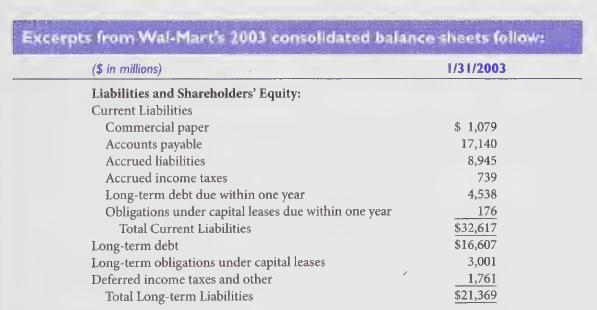

6. Wal-Mart’ total shareholders’ equity listed on its January 31, 2003 consolidated balance

sheet was \($39,337\) million. This gives a long-term debt-to-shareholders’ equity ratio of

54.3%. Calculate Wal-Mart’s total long-term debt-to-shareholders’ equity ratio after treating

its operating leases as if they were capital leases. (Ignore tax effects.)

7. Comment on the differences between the unadjusted and adjusted ratios.

Step by Step Answer: