AMR Corporation is the parent of American Airlines, one of the largest airline companies in the world.

Question:

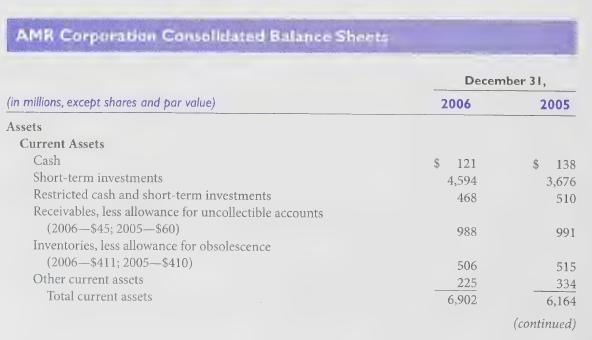

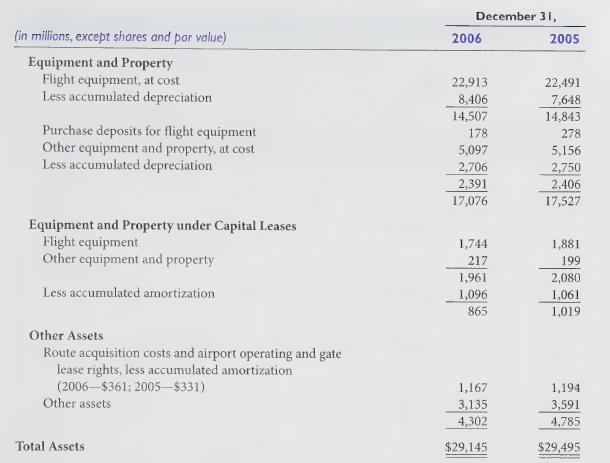

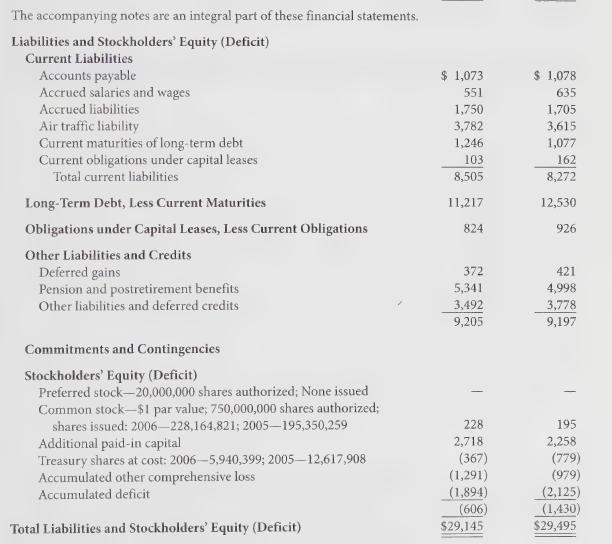

AMR Corporation is the parent of American Airlines, one of the largest airline companies in the world. Excerpts from its 2006 annual report follow.

The accompanying notes are an integral part of these financial statements.

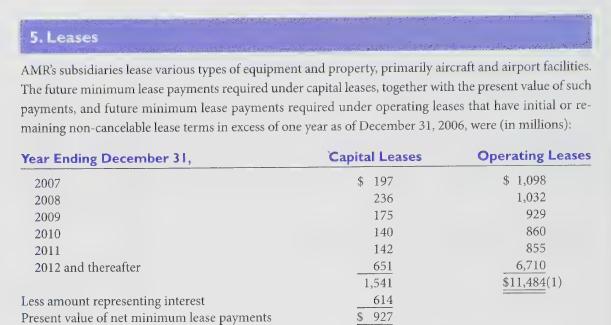

(1) As of December 31, 2006, included in Accrued liabilities and Other liabilities and deferred credits on the accompanying consolidated balance sheet is approximately \($1.4\) billion relating to rent expense being recorded in advance of future operating lease payments.

At December 31, 2006, the Company was operating 210 jet aircraft and 21 turboprop aircraft under operating leases and 89 jet aircraft and one turboprop aircraft under capital leases. The aircraft leases can generally be renewed at rates based on fair market value at the end of the lease term for one to five years.

Some aircraft leases have purchase options at or near the end oft he lease term at fair market value, but generally not to exceed a stated percentage of the defined lessor’s cost of the aircraft or a predetermined fixed amount.

Rent expense, excluding landing fees, was \($1.4\) billion, \($1.3\) billion and \($1.3\) billion in 2006, 2005 and 2004, respectively.

Required:

All questions relate to 2006 unless stated otherwise.

. What is the net amount of capital lease assets on the balance sheet?

. What is the total amount of capital lease obligations on the balance sheet?

. Why are the amounts in questions | and 2 different?

. Compute AMR’s total debt to total assets.

WHFFnwNePNW. What entry would AMR make in 2007 to record the effects of capital leases existing at December 31, 2006? You may omit the depreciation entry.

. What is the amount of operating lease obligations on the balance sheet?

. What is the present value of operating lease payments? Assume a 10% discount rate.

. What entry would be made to constructively capitalize the leases. (Ignore the effects of taxes.)

NOR COMIN . recompute the total debt to total assets ratio after making the entry in requirement 8.

What is the percentage change from the ratio computed in requirement 4?

Step by Step Answer: