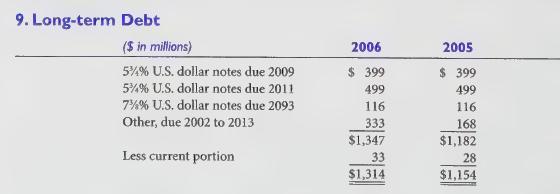

The following information is from Coca-Cola Companys 2006 annual report: The principal amount of our long-term debt

Question:

The following information is from Coca-Cola Company’s 2006 annual report:

The principal amount of our long-term debt that had fixed and variable interest rates, respectively, was \($1,346\) million and \($1\) million on December 31, 2006. . . [and] \($1,181\) million and \($1\) million on December 31, 2005.

The weighted-average interest rate on long-term debt was 6 percent for both years ended December 31, 2006 and 2005, respectively. Total interest paid was approximately \($212\) million, \($233\) million, and \($188\) million in 2006, 2005, 2004, respectively. Maturities of long-term debt for the five years succeeding December 31, 2006, are as follows (in millions): 2007—\($33\) 2008—\($175\) 2009—\($436\) 2010—\($55\) and 2011—\($522\) .

Required:

1.How much of Coca-Cola's long-term debt is due in 2007?

Cases 679 2. How much of Coca-Cola's long-term debt is due in each of the next 4 years (2008-2011)?

3. Why might financial analysts be interested in these scheduled debt payments? What options does the company have with regard to making its payments?

4. Compute the company’s effective interest rate for 2006 using the reported cash interest payments and the average amount of debt outstanding during the year. In addition to long-term debt stated in the report, the company had \($3,877\) million in average short-term debt outstanding.

5. What will the company’s interest expense be for 2007?

6. Why might the effective interest rate calculation described in requirement 4 misstate a company’s true interest cost when debt is issued at a premium or discount?

might obtain the cash needed to make this payment.

7. Approximately \($436\) million of long-term debt is due in 2009. Describe how the company 8. Approximately \($116\) million of long-term debt is due in 2093 because Coca-Cola is one of those companies that has issued “century bonds”). Describe the accounting and income tax issues raised by this maturity date.

Step by Step Answer: