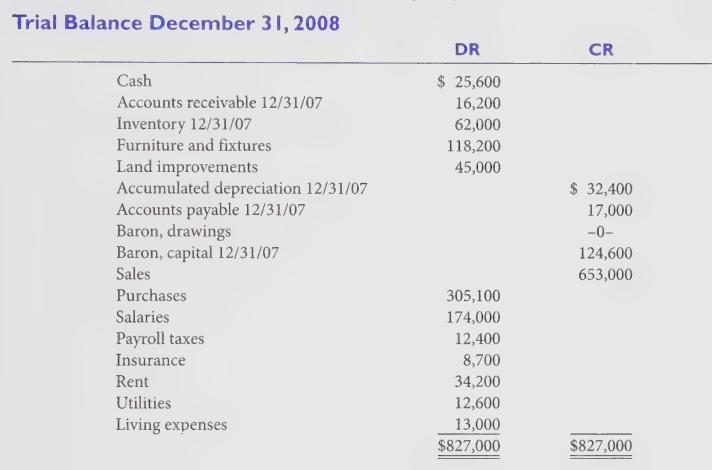

The following information pertains to Baron Flowers, a calendar-year sole proprietorship, which maintained its books on the

Question:

The following information pertains to Baron Flowers, a calendar-year sole proprietorship, which maintained its books on the cash basis during the year.

The “Baron, drawings” account is used to record any distributions to Mark Baron. The “Baron, capital” account is used to record any capital contributions that Baron makes to the business and any profits or losses retained in the business.

Baron has developed plans to expand into the wholesale flower market and is in the process of negotiating a bank loan to finance the expansion. The bank is requesting 2008 financial statements prepared on the accrual basis of accounting from Baron. During the course of a review engagement, Sue Muir, Baron’s accountant, obtained the following additional information:

1. Amounts due from customers totaled \($32,000\) at December 31, 2008.

2. An analysis of the receivables revealed that an allowance for uncollectible accounts of \($3,800\) should be provided.

3. Unpaid invoices for flower purchases totaled \($30,500\) and \($17,000\) at December 31, 2008, and December 31, 2007, respectively.

4. A physical count of the goods at December 31, 2008 determined that the inventory totaled \($72,800\). The inventory was priced at cost, which approximates market value.

5. On May 1, 2008, Baron paid \($8,700\) to renew its comprehensive insurance coverage for one year. The premium on the previous policy, which expired on April 30, 2008, was \($7,800\).

6. On January 2, 2008, Baron entered into a 25-year operating lease for the vacant lot adjacent to his retail store, which was to be used as a parking lot. As agreed to in the lease, Baron paved and fenced in the lot at a cost of \($45,000\). The improvements were completed on April 1, 2008, and have an estimated useful life of 15 years. No provision for depreciation or amortization has been recorded. Depreciation on furniture and fixtures was \($12,000\) for 2008.

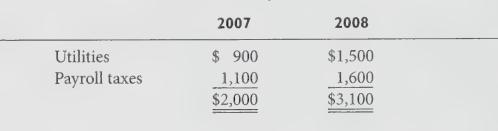

7. Accrued expenses at December 31, 2007 and 2008 follows:

8. Baron was notified late in the year of a lawsuit filed against his business for an injury to a customer. His attorney believes that the unfavorable outcome is probable and that a reasonable estimate of the settlement exclusive of amounts covered by insurance is \($50,000\).

9. The Salaries account includes \($4,000\) per month paid to the proprietor. He also receives \($250\) per week for living expenses. These amounts should have been charged to Baron's drawing account.

Required:

1. Determine the adjustments required to convert Baron Flowers’ trial balance to the accrual basis of accounting for the year ended December 31, 2008. Prepare formal journal entries to support your adjustments.

2. Write a brief memo to Baron explaining why the bank would require financial statements prepared on the accrual basis instead of the cash basis.

Step by Step Answer: