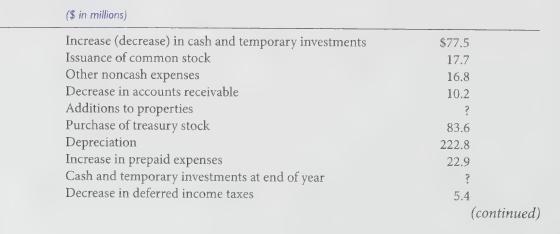

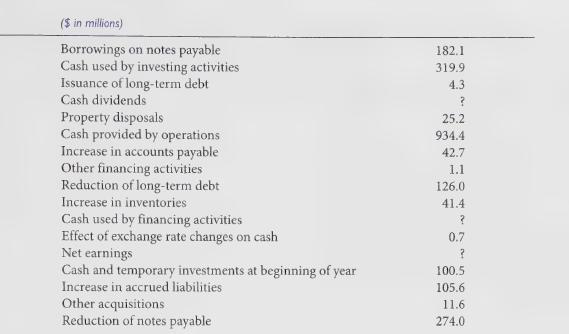

The following information was taken from Kellogg Companys Year 2 statement of cash flows. Kellogg is the

Question:

The following information was taken from Kellogg Company’s Year 2 statement of cash flows.

Kellogg is the world’s largest maker of ready-to-eat cereals. Its cereal products account for about 38% of the U.S. market and 52% oft he non-U.S. market. Some ofi ts more famous brandname products include Frosted Flakes, Rice Krispies, Fruit Loops, and Apple Jacks.

Required:

1. Determine the missing values and recast Kelloge’s Year 2 statement of cash flows, showing in good form cash flows from operations, investing, and financing activities. (Note: The item “Effect of exchange rate changes on cash” captures the gains or losses that arise when a firm converts its foreign subsidiaries’ financial statements from the respective currencies (for example, French francs) into U.S. dollars. In Kellogg’s case, these translations were favorable in Year 2.

This item should be treated as an adjustment to aggregate net cash flows to arrive at the change in cash. This adjustment usually appears near the bottom of the statement of cash flows.)

2. How did Kellogg fund its investing activities during Year 2?

3. How much cash did depreciation provide during Year 2?

4. Cash provided by operations was $934.4 million in Year 2, yet Kellogg’s Cash account balance increased by only $77.5 million during the year. How can this be?

Step by Step Answer: