Use the following information and your knowledge of financial ratios and balance sheet relationships to fill in

Question:

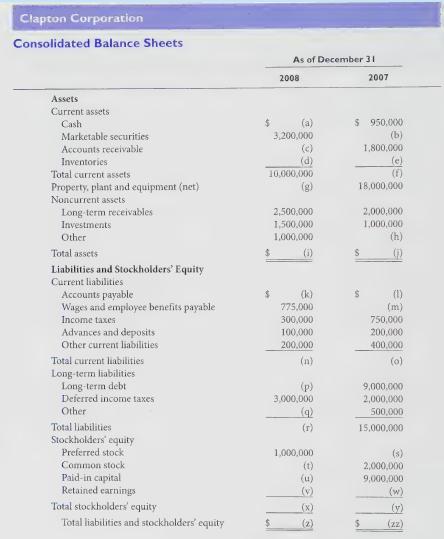

Use the following information and your knowledge of financial ratios and balance sheet relationships to fill in the missing items on the balance sheet of Clapton Corporation. Round all amounts to the nearest dollar.

Additional Information:

. Days accounts payable outstanding was 45.6 in 2008 compared to 66.3 in 2007.

. The current ratio at the end of 2008 was 2.5 compared to 2.0 at the end of 2007.

. The firm’s gross profit rate was 25% in 2008 and 28% in 2007.

. Net income for 2008 was \($1,250,000\) compared to \($1,000,000\) in 2007.

No common or preferred stock was issued during 2008.

. Return on average assets was 5% for 2008 compared to 8% in 2007.

. Cash dividends declared and paid in 2008 were \($250,000;\) in 2007 they were \($200,000.

.\) Days accounts receivable outstanding was 36.5 in 2008 and 50.5 in 2007.

. The long-term debt to total asset ratio at the end of 2008 was 0.40 compared to 0.30 at the end of 2007.

. The quick ratio at the end of 2008 was 1.6875 compared to 1.5 at the end of 2007.

. Days inventory held was 60.8 in 2008 and 75.7 in 2007.

. Net sales in 2008 were \($20,000,000\) compared to \($18,000,000\) in 2007.

. Earnings before interest (EBI) for 2008 was \($1,750,000\), compared to \($1,400,000\) in 2007.

Helpful Hints:

Start by calculating the missing values for common and preferred stock. Then compute total assets for 2007.

Total assets for 2008 can be found using 2007 total assets and the additional information in items (6) and (13).

Accounts receivable for 2008 can be found using 2007 accounts receivable along with the information in items (8) and (12).

Step by Step Answer: