Weir Company (a fictional company) uses straight-line depreciation for its property, plant, and equipment, which, stated at

Question:

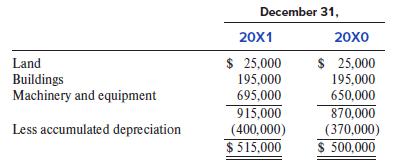

Weir Company (a fictional company) uses straight-line depreciation for its property, plant, and equipment, which, stated at cost, consisted of the following:

Weir’s depreciation expenses for 20X1 and 20X0 were $55,000 and $50,000, respectively.

Required:

What amount was debited to accumulated depreciation during 20X1 because of property, plant, and equipment retirements?

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Financial Reporting And Analysis

ISBN: 9781260247848

8th Edition

Authors: Lawrence Revsine, Daniel Collins, Bruce Johnson, Fred Mittelstaedt, Leonard Soffer

Question Posted: