Based on Abays criteria, the business segment best suited for divestiture is: A. medical equipment. B. power

Question:

Based on Abay’s criteria, the business segment best suited for divestiture is:

A. medical equipment.

B. power and industrial.

C. automation equipment.

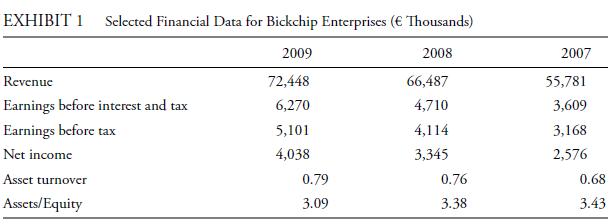

Quentin Abay, CFA, is an analyst for a private equity firm interested in purchasing Bickchip Enterprises, a conglomerate. His first task is to determine the trends in ROE and the main drivers of the trends using DuPont analysis. To do so he gathers the data in Exhibit 1.

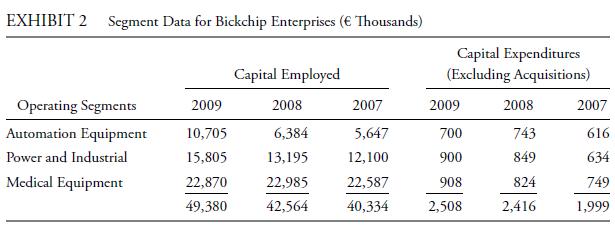

After conducting the DuPont analysis, Abay believes that his firm could increase the ROE without operational changes. Further, Abay thinks that ROE could improve if the company divested segments that were generating the lowest returns on capital employed (total assets less non-interest-bearing liabilities). Segment EBIT margins in 2009 were 11 percent for Automation Equipment, 5 percent for Power and Industrial, and 8 percent for Medical Equipment. Other relevant segment information is presented in Exhibit 2.

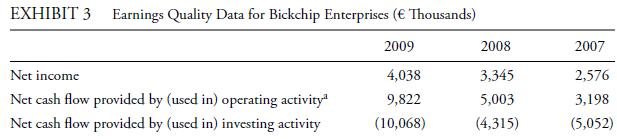

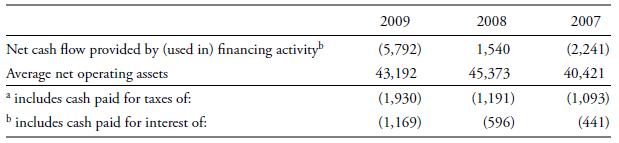

Abay is also concerned with earnings quality, so he intends to calculate Bickchip’s cash-flow-based accruals ratio and the ratio of operating cash flow before interest and taxes to operating income. To do so, he prepares the information in Exhibit 3.

Step by Step Answer:

International Financial Statement Analysis CFA Institute Investment Series

ISBN: 9780470287668

1st Edition

Authors: Thomas R. Robinson, Hennie Van Greuning CFA, Elaine Henry, Michael A. Broihahn, Sir David Tweedie